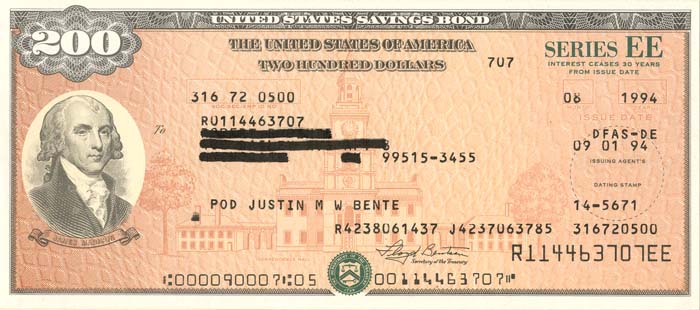

$200 U.S. Savings Bond

Inv# TB1060 Bond

$200, Series EE United States Savings Bond. Rare! United States savings bonds are debt instruments issued by the U.S. Department of the Treasury to assist in meeting the borrowing requirements of the government. These bonds are regarded as one of the most secure investment options since they are supported by the full faith and credit of the U.S. government. The savings bonds are nonmarketable treasury securities made available to the public, meaning they cannot be traded on secondary markets or transferred in any other manner. They can only be redeemed by the original buyer or a designated beneficiary in the event of the buyer's death.

On February 1, 1935, President Franklin D. Roosevelt enacted legislation permitting the U.S. Department of the Treasury to issue a new form of security known as the savings bond, aimed at promoting savings during the Great Depression. The inaugural Series A savings bond was released a month later, with a nominal value of $25. These bonds were promoted as a secure investment option accessible to all. Subsequent Series B, C, and D bonds were introduced in the following years.

Series E bonds, known as Defensive Bonds, served as a significant source of funding just prior to the United States' involvement in World War II. On April 30, 1941, Roosevelt acquired the first Series E bond from Treasury Secretary Henry Morgenthau, Jr.; the following day, they were made available to the general public. Following the attack on Pearl Harbor, Defensive Bonds were rebranded as War Bonds. Stamps featuring a Minuteman statue design, available in denominations of 10¢, 25¢, 50¢, $1, and $5, were also sold for collection in booklets, which could be exchanged for interest-bearing Series E bonds once filled. All proceeds from the bonds were directly allocated to support the war effort.

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Ebay ID: labarre_galleries