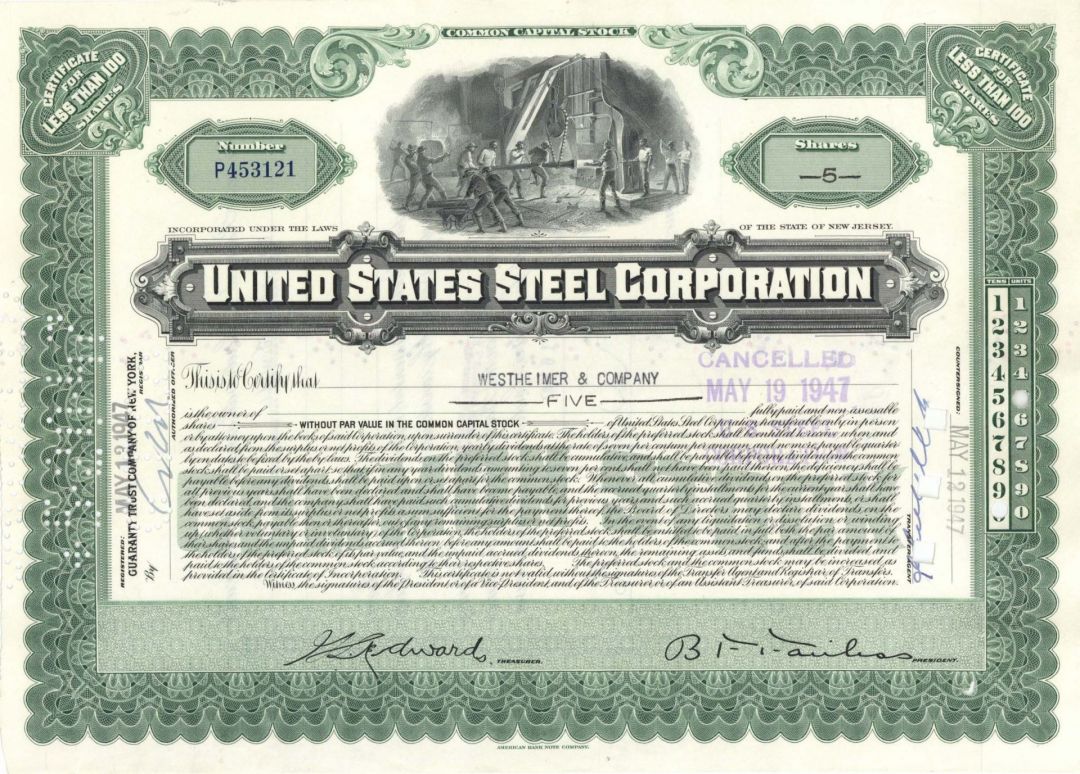

United States Steel Corp. - 1920's-50's dated Steel Stock Certificate - Bought Carnegie Steel for $492 Million

Inv# GS1260 StockStock w/ vignette of steelworkers in a steel mill. Very attractive borders. Great stock of one of America's most historic companies. Available in Green, Brown or Olive. Please specify color.

In 1901, the United States Steel Corporation, a newly formed entity by J.P. Morgan, acquired Carnegie Steel Company. The transaction was valued at around $492 million, which translates to approximately $14.8 billion in 2019, with Carnegie receiving $226 million from the deal. U.S. Steel functioned as a conglomerate, encompassing various subsidiary companies, one of which was renamed the Carnegie-Illinois Steel Company in 1936.

Commonly known as U.S. Steel, the United States Steel Corporation is an integrated steel manufacturer headquartered in Pittsburgh, Pennsylvania, with production facilities in both the United States and Central Europe. As of 2018, it was ranked as the 27th largest steel producer in the world and the second largest in the United States, following Nucor Corporation. The company changed its name to USX Corporation in 1986 but reverted to United States Steel in 2001 after divesting its energy sector, which included Marathon Oil and other related assets. U.S. Steel was founded on March 2, 1901, by J.P. Morgan, who facilitated the merger of Andrew Carnegie's Carnegie Steel Company, Elbert H. Gary's Federal Steel Company, and William Henry "Judge" Moore's National Steel Company for a total of $492 million, which is approximately $15.31 billion in today's currency.

U.S. Steel was historically recognized as the largest steel manufacturer and the foremost corporation globally. Initially valued at $1.4 billion, this amount equates to approximately $43.6 billion in today's terms, marking it as the first corporation in history to achieve a billion-dollar valuation. The company set up its headquarters in the Empire Building located at 71 Broadway in New York City, where it continued to be a prominent tenant for 75 years. Charles M. Schwab, an executive from Carnegie Steel who suggested the merger to Morgan, was appointed as the inaugural President of the newly established corporation.

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries