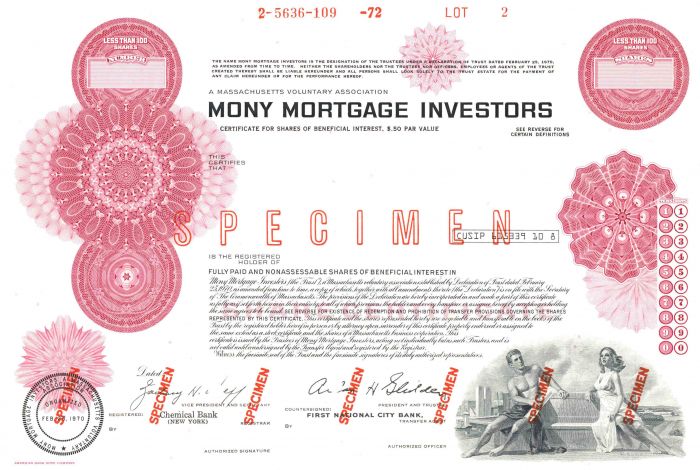

Mony Mortgage Investors - Specimen Stock Certificate

Inv# SE2179 Specimen Stock

Specimen Stock printed by American Bank Note Company.

In the early 1870s, the American mortgage market underwent a transformative shift as novel financial intermediaries emerged to bridge the disparity between capital-rich eastern markets and the expanding frontier. Formed around 1870, companies such as the United States Mortgage Company (established in 1871) pioneered the utilization of mortgage-backed securities (MBS), an innovation introduced from Europe. These entities circumvented the limitations of national banks, which were predominantly prohibited from lending in the real estate sector at the time, by issuing bonds backed by their mortgage holdings to institutional investors in the Northeast and Europe.

This era of innovation was catalyzed by influential financiers, including J. Pierpont Morgan, who served on the boards of these early mortgage trusts to facilitate the allocation of capital toward agricultural expansion in the West and urban development in the East. While these entities provided essential liquidity for a burgeoning nation, the absence of uniformity and the recurrent financial panics of the Gilded Age, such as the Panic of 1873, rendered numerous early mortgage investors vulnerable. The majority of these pioneering institutions ultimately succumbed during the mortgage crisis of the 1890s, leaving life insurance companies as the primary survivors and dominant interregional lenders.

Stock and Bond Specimens are made and usually retained by a printer as a record of the contract with a client, generally with manuscript contract notes such as the quantity printed. Specimens are sometimes produced for use by the printing company's sales team as examples of the firms products. These are usually marked "Specimen" and have no serial numbers.

Ebay ID: labarre_galleries