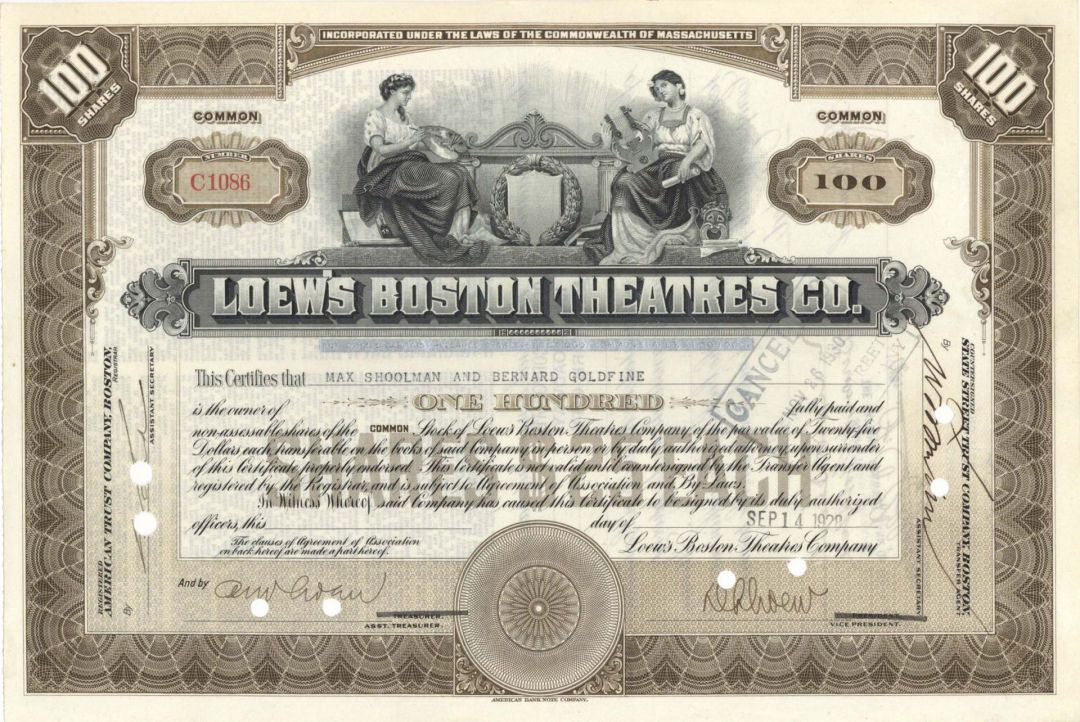

Loew's Boston Theatres Co. - 1923-1944 dated Stock Certificate

Inv# ET1012 StockStamp and hole cancelled Stock. Interesting vignette by American Bank Note Co. Available in Brown-100 share and Blue-less than 100 share. Attractive. Available in Brown or Blue. Please specify color.

Loews Corporation, an American conglomerate headquartered in New York City, owns a diverse portfolio of companies, including CNA Financial Corporation, Boardwalk Pipeline Partners, Loews Hotels, and Altium Packaging. Loews Corporation positions itself as a value investor with a long-term focus. In recent years, the company has also allocated significant capital for share buybacks. Between 1971 and 2020, Loews spent $1.3 billion repurchasing shares, reducing its shares outstanding from 1.3 billion to 291 million.

The roots of Loews Corporation can be traced back to 1946 when Laurence Tisch persuaded his parents to invest $125,000 in a resort hotel in Lakewood, New Jersey. Laurence’s brother Robert joined the business shortly thereafter. The Tisch brothers began investing their profits in expanding the hotel business. By 1956, they were in a position to build their first hotel, the Americana in Bal Harbour, Florida, for $17 million in cash. Following the landmark 1948 Supreme Court antitrust ruling in United States v. Paramount Pictures, Inc., all major movie studios, including Metro-Goldwyn-Mayer (MGM), were compelled to sell off the movie theater chains they owned and operated.

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries