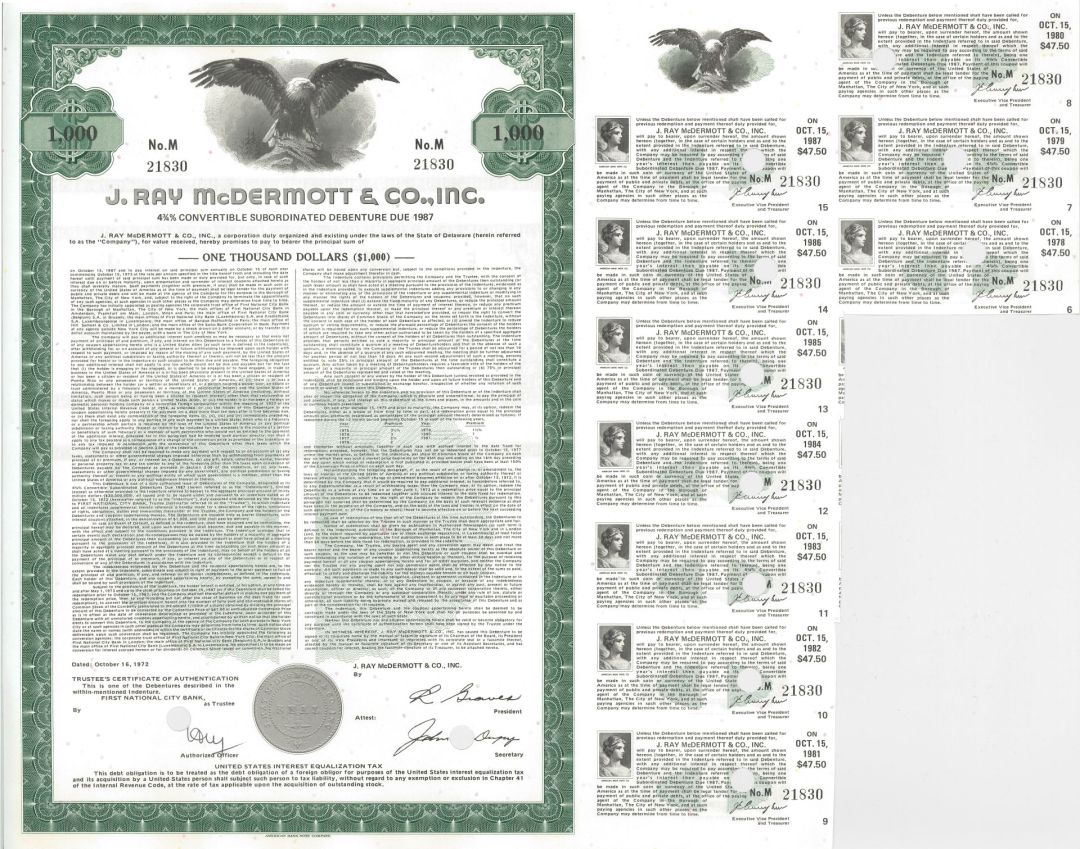

J. Ray McDermott & Co., Inc. - $1,000 Bond

Inv# GB5651 Bond$1,000 Bond.

McDermott International, Ltd is a global provider of engineering and construction solutions to the energy industry. Operating in over 54 countries, McDermott's locally-focused and globally-integrated resources include more than 40,000 employees, a diversified fleet of specialty marine construction vessels and fabrication facilities around the world. Incorporated in Bermuda, it is headquartered in the Energy Corridor area of Houston, Texas.

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Ebay ID: labarre_galleries