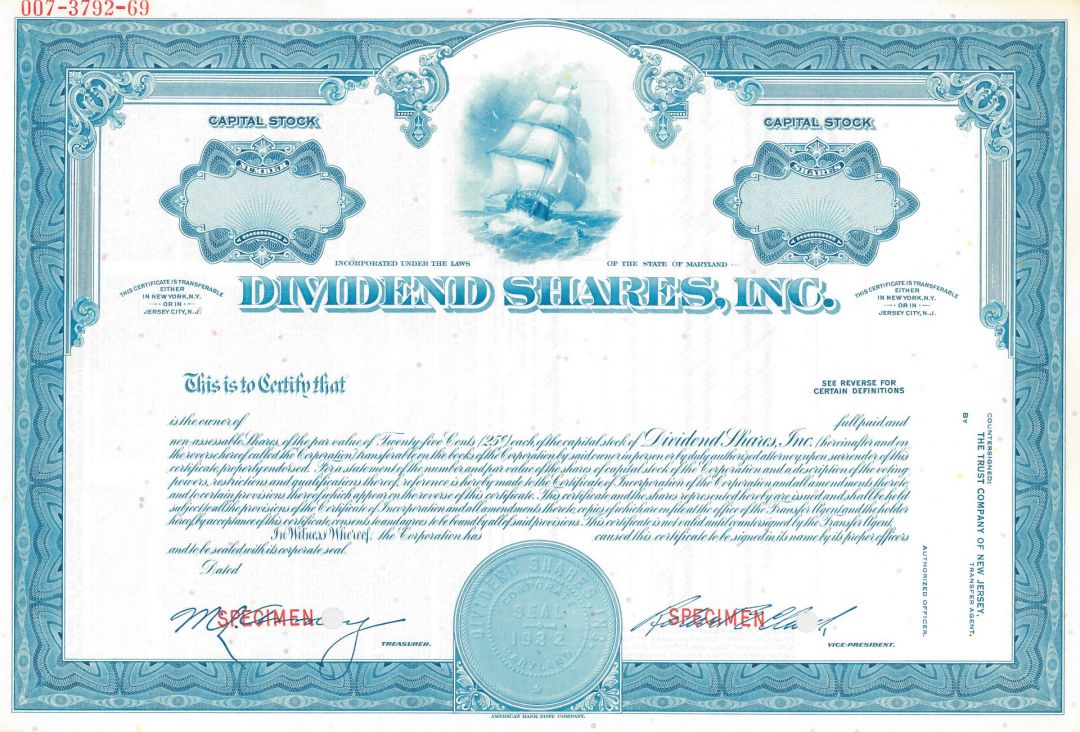

Dividend Shares, Inc - Specimen Stock Certificate

Inv# SE1770 StockSpecimen Stock printed by American Bank Note Company. Dividends paid on SIP shares can be re-invested in further shares known as Dividend Shares. Before 6 April 2013, the maximum amount of dividend reinvestment was £1,500 per participant in a tax year. From 6 April 2013, the statutory reinvestment limit ceased to apply, however employers may continue to specify a limit if they choose. These shares are free of Income Tax and National Insurance at the date of purchase. An employee can only take their Dividend Shares out of the SIP in the 3-year period from the date of award if they leave the company. Dividend Shares are subject to a 3-year holding period. If the shares are removed after 3 years from the date of award there is no Income Tax or National Insurance liability. In certain circumstances, prescribed by HMRC, there can be no Income Tax or National Insurance liability when the employee leaves the company, no matter how long the shares have been held in the plan. Read more at https://en.wikipedia.org/wiki/Share_Incentive_Plan#Dividend_Shares

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries