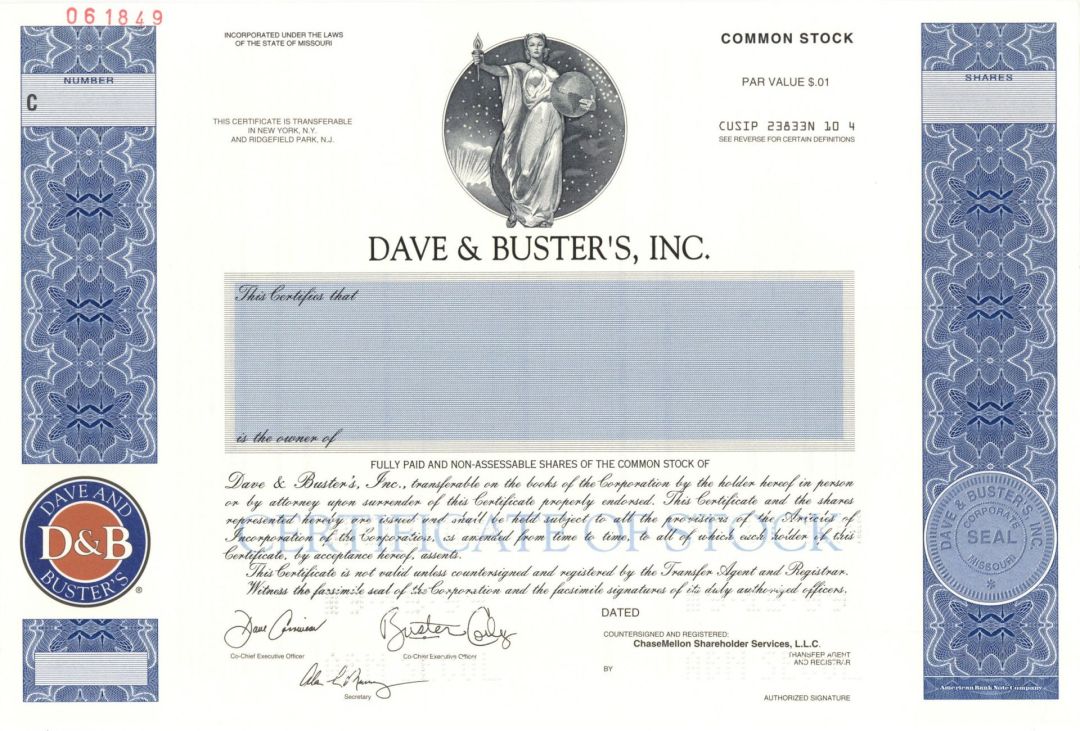

Dave and Buster's, Inc. - Specimen Stocks and Bonds

Inv# SE3449 Specimen StockNew Jersey

New York

Specimen Stock printed by American Bank Note Company.

Dave & Buster's (stylized in all caps) is an American restaurant and entertainment business headquartered in Dallas. Each Dave & Buster's has a full-service restaurant, full bar, and a video arcade. As of September 2023, the company has 156 locations in the United States, two in Puerto Rico and two in Canada. The first Dave & Buster's was opened in Dallas in 1982 by David Corriveau and James "Buster" Corley. Corley had previously operated a bar called "Buster's" in Little Rock, Arkansas, next door to a saloon and game parlor called "Cash McCool's", owned by Corriveau. After opening Dave & Buster's, the two operated as co-CEOs. In 1989, Edison Brothers Stores purchased a majority ownership in the restaurant to finance further expansion into other cities. Dave & Buster's was spun off from Edison Brothers, and went public with Andy Newman as chairman in 1995. By 1997 the chain had ten locations across the country. D&B acquired nine Jillian's locations after Jillian's filed for Chapter 11 Bankruptcy in 2004. Seven of these Jillian's locations were rebranded with the Dave & Buster's name, while two were closed following the acquisition. The company announced on December 8, 2005, that it would be acquired by private equity firm Wellspring Capital Management. On July 16, 2008, Dave & Buster's Holdings Inc, filed with the SEC to again become a publicly traded company. The company had set a date for the Initial public offering IPO of October 5, 2012. However, it pulled out right before it opened. In June 2010, Oak Hill Capital Partners, in partnership with the company's management team, completed its acquisition of Dave & Buster's from Wellspring Capital Management. In October 2014, Dave & Buster's launched a second IPO, selling 5.88 million shares at an offering price range of $16â18. The offering raised $94 million, to be used for debt repayments. Shares are traded on the NASDAQ stock exchange using the symbol PLAY. Dave & Buster's, as with all other entertainment and restaurant businesses, was affected by the COVID-19 pandemic due to restrictions on non-essential businesses. The company's same-store sales fell by 70% during fiscal year 2020. As restrictions eased, the company began to recover in fiscal year 2021, being down only 10%, although Omicron variant resulted in a decrease in the fourth quarter of 2021. Dave & Buster's CEO Brian Jenkins retired in September 2021, with chairman Kevin Sheehan named interim CEO. On April 6, 2022, Dave & Buster's announced that it would acquire the Plano, Texas-based family entertainment center chain Main Event Entertainment from Ardent Leisure and RedBird Capital Partners for $835 million, with its CEO Chris Morris becoming the new CEO of Dave & Buster's upon the completion of the sale in June 2022. Main Event will operate alongside the main Dave & Buster's chain, differentiated by their formats (with Main Event locations typically being larger than the average Dave & Buster's location, and including activities such as bowling and laser tag) and market positioning (with Main Event having typically targeted families, and Dave & Buster's having typically targeted young adults). Dave & Buster's has not ruled out the possibility of converting some of its larger locations to the Main Event format, and opening smaller Dave & Busters locations in the same market to supplant them.

Stock and Bond Specimens are made and usually retained by a printer as a record of the contract with a client, generally with manuscript contract notes such as the quantity printed. Specimens are sometimes produced for use by the printing company's sales team as examples of the firms products. These are usually marked "Specimen" and have no serial numbers.

Ebay ID: labarre_galleries