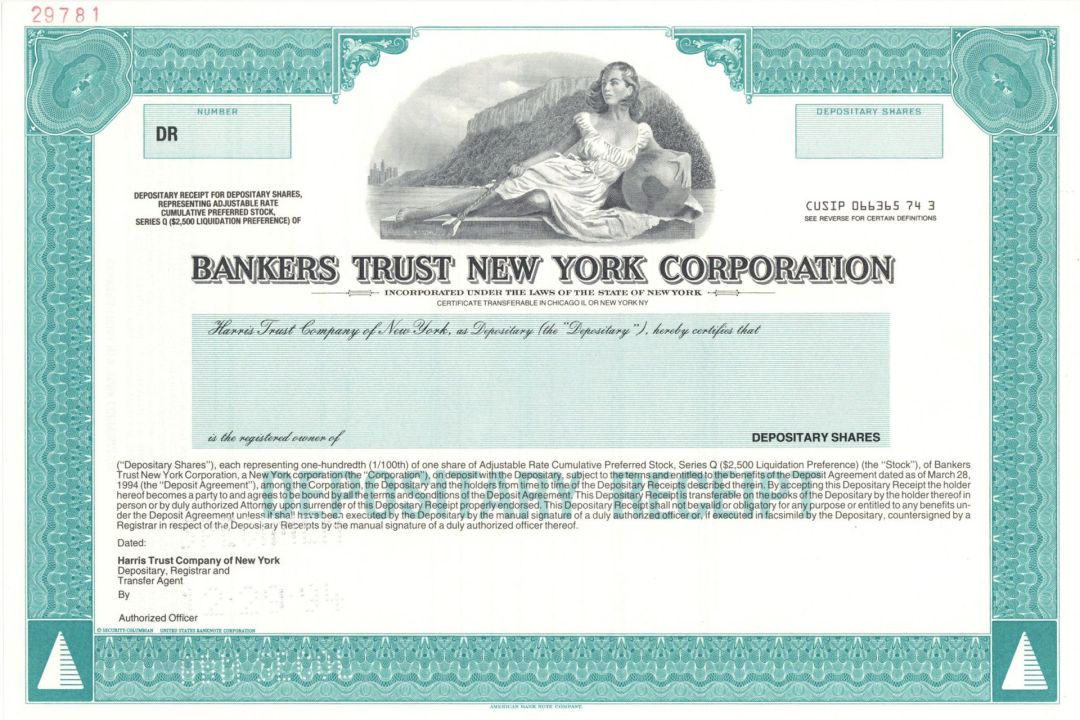

Bankers Trust New York Corp. - Specimen Depositary Receipt Certificate

Inv# SE3510 Specimen StockSpecimen Depositary Receipt printed by American Bank Note Company. Available in Aqua or Blue. Please specify color.

Bankers Trust New York Corporation, a multibillion-dollar bank holding company, is one of the largest commercial banks in the United States. The nature of the company's business has changed repeatedly since it was founded in 1903. It was first a bankers trust company; by the end of the 1920s it was a wholesale financial-services provider; next it was a retail banking supermarket in the 1960s, with nearly disastrous results; and finally it became a wholesale banker again. Thanks to former Chairman Alfred Brittain III and his successor, Charles S. Sanford, Bankers Trust is now a strong international merchant bank, providing a variety of wholesale banking services to governments, institutions, corporations, and wealthy individuals in the United States and abroad. In the 1890s and early 1900s, national banks were at a competitive disadvantage to state-chartered trust companies and other financial institutions. The United States was industrializing rapidly and credit needs of growing companies offered the financial-services industry many opportunities for profit and growth. National banks, however, were regulated so stringently that they could not take full advantage of these opportunities. Unlike trust companies, national banks had to satisfy strict capital and reserve requirements, could not branch nationally or overseas, and had no trust powers. In 1903 a group of New York national banks decided to fight the trust companies on their own ground. The banks formed a trust company, Bankers Trust, to provide trust services to customers of state and national banks throughout the country. Banks could safely refer their fiduciary business to Bankers Trust because the new company would not compete with them for interest-bearing deposits as other trust companies did. Bankers Trust Company was incorporated on March 24, 1903, with an initial capital of $1.5 million. Legendary financier J. P. Morgan held a controlling interest, and Edmund C. Converse, a very successful steel manufacturer turned financier and then president of Liberty National Bank, was chosen to serve as Bankers Trust's first president. Bankers Trust opened its doors at 143 Liberty Street on March 30, 1903. Within three months it had deposits totalling $5.75 million; within four months it had outgrown its original premises and moved to Wall Street. Bankers Trust's stability during the March, 1907 money panic bolstered the company's reputation. A year after that panic, Converse decided to diversify the company's services. Accordingly, in 1908, Bankers Trust established a foreign department to process transactions with correspondent banks. The following year, the company promoted and distributed traveler's checks for the American Bankers Association. The traveler's checks were successful in the United States and abroad, and the company's capital grew to $7.5 million. Two years later, Bankers Trust made its first merger. Merger prospects were plentiful at the time because the New York State Assembly had recently enacted antitrust legislation requiring insurance companies to divest their banking and trust interests. In August, 1911 Bankers Trust acquired the Mercantile Trust Company, and in March, 1912 it acquired the Manhattan Trust Company. These mergers raised the company's capital to $20 million and its deposit base to over $134 million. Within nine years its deposits reached $168 million and its capital and surplus had increased to $25 million. In January, 1914 Converse resigned to become president of Astor Trust Company, another Morgan company. Benjamin Strong Jr., Converse's son-in-law, succeeded him. Strong served as president for less than a year, leaving Bankers Trust to become the first governor of the Federal Reserve Bank of New York after helping to establish the Federal Reserve system. Seward Prosser was elected to succeed him. In the early years of his leadership, Prosser faced a crucial challenge. State institutions had been granted the right to perform trust functions and national banks expected to receive this privilege shortly; such a restricted-purpose organization was no longer needed. In addition, the Federal Reserve banks increasingly held the reserve deposits of national and state banks, a service that Bankers Trust had provided for years.

Prosser transformed Bankers Trust from a single-purpose organization into a full-service commercial bank. In April, 1917 Bankers Trust acquired the Astor Trust Company, still headed by Converse. Prosser made Astor Trust into Bankers Trust's first retail branch. In October, 1917 the organization became a member of the Federal Reserve system. Bankers Trust was now a commercial bank and Prosser, who became the company's first chairman in 1923 and was succeeded as president by A. A. Tilney, turned his attention to diversifying services. In 1919 the three year old securities department was expanded and developed into a bond department. In March of that year, a special wire office was opened in Chicago to facilitate nationwide distribution of the bond department's offerings. Wire offices were soon opened in 11 more U.S. cities. In 1928 the bank formed the Bankers Company, a wholly owned subsidiary, to replace the bond department and take over the business of underwriting and distributing securities. The postwar boom in foreign travel and business encouraged Prosser to establish a Paris office in 1920. Two years later an agency was opened in London for the convenience of American customers traveling in England. The agency was so successful that a permanent office was opened in 1924. By 1928 Bankers Trust was one of the leading U.S. banks in Europe. Bankers Trust was also a pioneer in the field of pension management. The company had established a pension plan for its own employees in 1913. Gradually, it started a similar service for its corporate customers. In the 1920s, the trust division began packaging pension and other employee-benefit plans for companies like the Bell System. These plans soon made up a major part of the company's trust business. Read more: https://www.referenceforbusiness.com/history2/27/BANKERS-TRUST-NEW-YORK-CORPORATION.html#ixzz8LgHz2Vmn

Stock and Bond Specimens are made and usually retained by a printer as a record of the contract with a client, generally with manuscript contract notes such as the quantity printed. Specimens are sometimes produced for use by the printing company's sales team as examples of the firms products. These are usually marked "Specimen" and have no serial numbers.

Ebay ID: labarre_galleries