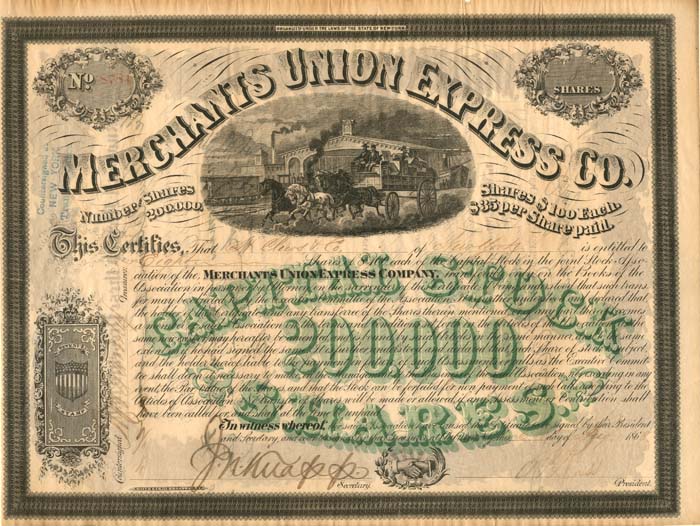

Merchants Union Express Co. Issued to H. Clews and Co. - 1868 dated Stock Certificate

Inv# AX1029 Stock

Stock issued to H. Clews & Co.

Established in 1866, the Merchants Union Express Company emerged as a formidable competitor to the well-established American Express Company. Upon its formation, the Merchants Union Express Company initiated a vigorous and aggressive rate war, substantially reducing American Express’s prices to secure market share. This intense two-year struggle for dominance in the express transportation industry drove both companies to the precipice of financial ruin, as they invested heavily in attempting to eliminate the other from the market.

Facing mutual collapse, the exhausted rivals mutually agreed to merge on November 25, 1868, forming a consolidated entity initially designated as the American Merchants Union Express Company. William Fargo oversaw the combined operation. Following the merger’s completion and the industry’s stabilization, the company was renamed the American Express Company in 1873. The brief existence and subsequent merger of the Merchants Union Express Company were pivotal moments in American business history. They directly contributed to the establishment and enduring success of the contemporary American Express brand, which transitioned from primarily a package carrier to the global financial services powerhouse it is today.

Henry Clews, born on August 14, 1834, was a British-American financier and author. After emigrating to the United States in 1853, he began his career at Wilson G. Hunt & Company, working as a junior clerk in a pottery import business. Later, he organized the firm of Stout, Clews & Mason and eventually brought his brother James Clews from England to assist him in managing a branch of the brokerage firm. In 1859, Clews co-founded Livermore, Clews, and Company, which became the second-largest bond marketer during the United States Civil War.

In 1877, Clews split away and established Henry Clews & Company, a member of the New York Stock Exchange. This venture made him incredibly wealthy.

Politically, Clews was a Republican. He played a significant role in organizing the “Committee of 70,” which successfully deposed the corrupt ring associated with William M. Tweed in New York City. Clews was also a friend of President Abraham Lincoln and served as an economic consultant to President Ulysses Grant. In a notable quote about Grant & Ward, Grant’s brokerage firm with Ferdinand Ward, Clews remarked, “It is remarkable how the concept of substantial profits presented in a plausible manner can suppress suspicion.”

Henry Clews passed away on January 31, 1923, in New York City due to bronchitis. He was buried at Woodlawn Cemetery in the Bronx. His widow, who had lived to be 93, passed away at her home on 15 East 69th Street in New York on May 19, 1945.

Through his son Henry, he was the grandfather of Henry Clews III (1903–1983), Louise Hollingsworth Morris Clews (1904–1970), who married Ian Campbell, the 11th Duke of Argyll, and became the Duchess of Argyll, and Mancha Madison Clews (1915–2006), an electrical engineer.

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries