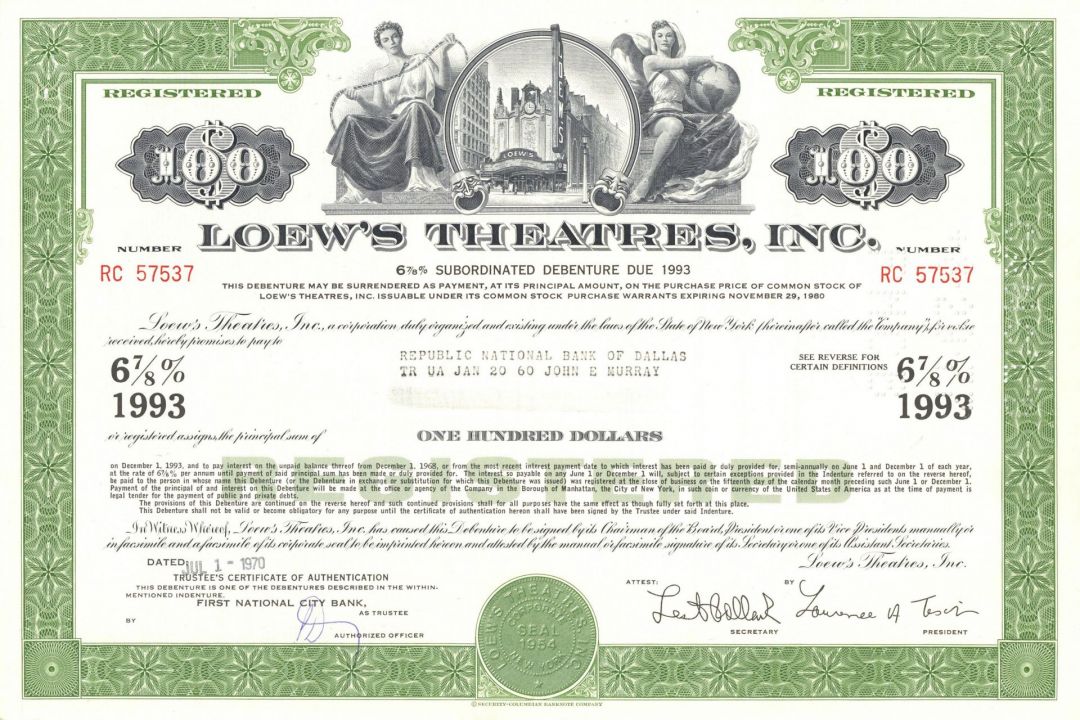

Loew's Theatres, Inc. - Movie Theater Chain Bond 1960's-80's - Entertainment

Inv# ET1002 Bond$1,000 Purple, $100 Green or Yellow (no denomination) 6 7/8% Bond. Neatly hole cancelled. Vignette of Loew’s Theater in NY by Security-Columbian Banknote. Excellent Condition! Available in Purple, Green or Yellow. Please specify color.

Loews Corporation, an American conglomerate headquartered in New York City, owns a diverse portfolio of companies, including CNA Financial Corporation, Boardwalk Pipeline Partners, Loews Hotels, and Altium Packaging. Loews Corporation positions itself as a value investor with a long-term focus. In recent years, the company has also allocated significant capital for share buybacks. Between 1971 and 2020, Loews spent $1.3 billion repurchasing shares, reducing its shares outstanding from 1.3 billion to 291 million.

The roots of Loews Corporation can be traced back to 1946 when Laurence Tisch persuaded his parents to invest $125,000 in a resort hotel in Lakewood, New Jersey. Laurence’s brother Robert joined the business shortly thereafter. The Tisch brothers began investing their profits in expanding the hotel business. By 1956, they were in a position to build their first hotel, the Americana in Bal Harbour, Florida, for $17 million in cash. Following the landmark 1948 Supreme Court antitrust ruling in United States v. Paramount Pictures, Inc., all major movie studios, including Metro-Goldwyn-Mayer (MGM), were compelled to sell off the movie theater chains they owned and operated.

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Ebay ID: labarre_galleries