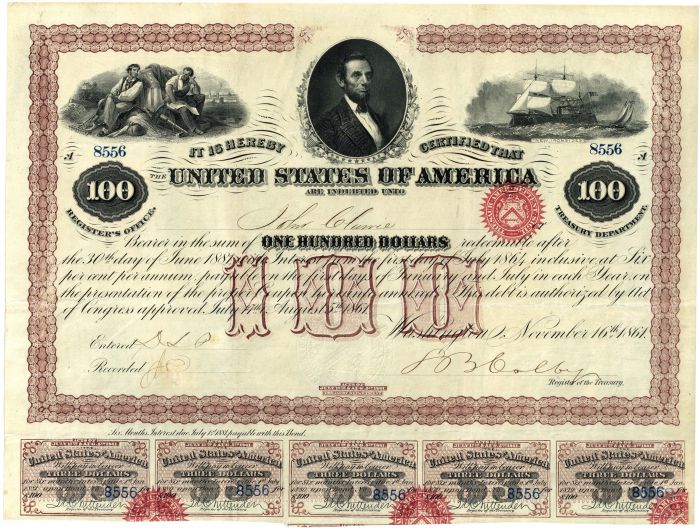

$100 United States of America Bond of 1861 - Only 2 or 3 known to Exist

Inv# TB1128 Bond

$100 United States of America Bond of 1861 - Only 2 or 3 known to Exist. Signed by Stoddard Benham Colby.

Stoddard Benham Colby (February 3, 1816 – September 21, 1867) was an American lawyer and political figure. He is recognized for his role as Register of the United States Treasury during the American Civil War. Colby was born in Derby, Vermont on February 3, 1816. He received his education in Derby and prepared for college by studying in the office of attorney Timothy P. Redfield. He graduated from Dartmouth College in 1836 and was elected to Phi Beta Kappa. He studied law under William Upham, was admitted to the bar, and practiced law in Derby. In 1840, he was elected to serve a single term in the Vermont House of Representatives, holding office from 1841 to 1843. In 1846, he began practicing in Montpelier as a partner of Lucius B. Peck.

In 1856, he ran as a Democratic candidate for the United States House of Representatives but was unsuccessful. Colby was appointed as Register of the Treasury and took office on August 12, 1864. He was married to Harriet Elizabeth Proctor, who was the sister of Senator Redfield Proctor. She was one of the victims of the Henry Clay (steamboat) disaster. Together, they had four children. Colby passed away in Haverhill, New Hampshire, after a five-week illness. He was interred at Proctor Cemetery in Proctorsville, Vermont.

The Revenue Act of 1861, officially known as the Act of August 5, 1861, Chap. XLV, 12 Stat. 292, marked the introduction of the first Federal income tax statute in the United States (refer to Sec.49). This Act was driven by the necessity to finance the Civil War and established an income tax that was to be "levied, collected, and paid, upon the annual income of every person residing in the United States, regardless of whether such income is generated from any type of property, or from any profession, trade, employment, or vocation conducted in the United States or elsewhere, or from any other source whatsoever [ . . . .]" The tax was a flat rate of 3% applied to incomes exceeding $800. Abraham Lincoln signed the Revenue Act of 1861 into law. The income tax provisions (Sections 49, 50, and 51) were later repealed by the Revenue Act of 1862. (Refer to Sec.89, which substituted the flat rate with a progressive tax structure of 3% on annual incomes exceeding $600 (equivalent to $16,286 in 2021) and 5% on incomes surpassing $10,000 (equivalent to $271,433 in 2021) or for those residing outside the U.S. Additionally, it was notably temporary, indicating the termination of the income tax in "the year eighteen hundred and sixty-six."

Before the onset of the Civil War, the United States encountered a financial depression that followed the Panic of 1857, an incident driven by excessive expansion of the domestic economy and a financial crisis in Europe. In the three years leading up to the Civil War, the Federal Government faced a budget deficit that surpassed $40 million. This deficit, combined with the looming threat of secession, placed significant financial pressure on the US government. In 1860, the US Treasury offered interest rates between 8 and 12 percent on government bonds to generate additional funds and cover public expenditures. In December 1861, the US Treasury sought to sell five million dollars in interest-bearing notes at a rate of 12 percent but was only able to sell four million. The difficulties faced by the Treasury highlight the unstable financial condition of the US government. As the nation moved closer to conflict, the necessity to organize a volunteer army imposed further financial challenges on the Federal government. Although treasury notes with attractive interest rates enabled the US government to quickly raise funds, they also created a demand for additional revenue sources to service the interest payments.

In March 1861, President Lincoln began to assess the federal government's capacity to conduct a war against the South from a logistical perspective. He corresponded with cabinet members such as Edward Bates, Salmon Chase, and Gideon Welles, questioning whether the president possessed the constitutional authority to impose duties ranging from import tariffs to property taxes. Records stored at the Library of Congress reveal that Lincoln was apprehensive about the Federal government's capability to collect tariffs from ports along the Southeastern coastline, given the imminent threat of secession.

On July 4, 1861, President Lincoln convened a special session of Congress with the specific aim of discussing the Civil War from a legislative perspective. A major issue confronting Congress was the matter of funding: with an abundance of volunteers, the Union Army faced significant costs as they trained and equipped a military force. President Lincoln remarked, "One of the greatest perplexities of the government, is to avoid receiving troops faster than it can provide for them. In a word, the people will save their government, if the government itself, will do its part." To generate approximately $50 million in revenue, lawmakers implemented a three-pronged strategy that included raising certain import tariffs, introducing a new property tax, and establishing the first personal income tax.

Under the guidance of Senator William Pitt Fessenden of Maine, who chaired the Senate Finance Committee, Congress quickly drafted the Revenue Act of 1861. Although the legislation successfully introduced import tariffs, property taxes, and a flat income tax rate of 3% for individuals earning over $800, it was deficient in terms of a robust enforcement mechanism. The bill sparked significant debate within Congress: Thaddeus Stevens, the chairman of the House Committee on Ways and Means, stated, "This bill is a most unpleasant one. But we perceive no way in which we can avoid it and sustain the government. The rebels, who are now destroying or attempting to destroy this Government, have thrust upon the country many disagreeable things." His remarks echoed the sentiment that the income and property taxes imposed by the bill were regrettable necessities. Ultimately, the bill was passed by Congress and signed into law by President Lincoln. Despite its extensive reforms, the lack of an effective enforcement mechanism, combined with the 3% flat tax rate, did not produce the anticipated revenue.

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Ebay ID: labarre_galleries