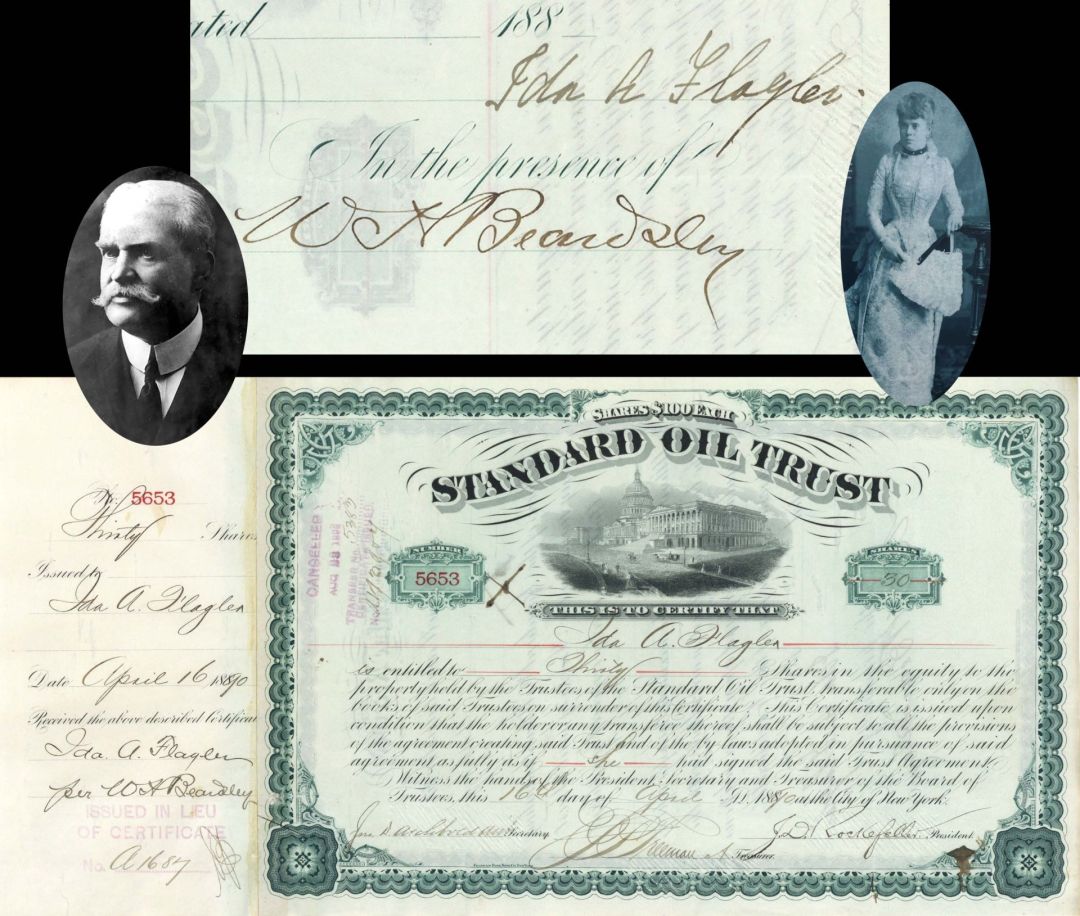

Standard Oil Trust Issued to and Signed by Ida A. Flagler - also signed by John D. Rockefeller, John D. Archbold and W.H. Beardsley - 1890 dated Autographed Oil Stock Certificate

Inv# AG3026 AutographOhio

Stock issued to Ida A. Flagler and signed on the back. Signed by J.D. Rockefeller as president and John D. Archbold as secretary on front. Signed by W.H. Beardsley on back.

Ida Alice Shourds Flagler, a prominent Gilded Age socialite, is often remembered more for the tragic end of her marriage than her life. As the second wife of Standard Oil co-founder and Florida developer Henry Flagler, Ida was known for her vibrant personality and keen interest in the arts and spiritualism. However, her life took a dark turn in the late 1890s when her mental health began to decline. She became increasingly fixated on the idea of marrying the Czar of Russia, leading to erratic behavior and public outbursts. In 1896, she was officially declared insane and committed to a private sanitarium in New York, where she spent the remainder of her life.

Ida’s legacy is inextricably linked to a controversial change in Florida law known as the “Flagler Divorce Law.” In 1901, Henry Flagler successfully lobbied the Florida legislature to make incurable insanity grounds for divorce, a law tailored specifically to allow him to dissolve his marriage to Ida. Shortly after the bill passed, Henry divorced her and married Mary Lily Kenan. Despite her confinement and the legal maneuvers that stripped her of her status, Ida was well-provided for financially. Upon her death in 1917, she left behind an estate valued at millions of dollars, largely consisting of Standard Oil stock that had appreciated significantly during her years in the asylum.

John Davison Rockefeller, Sr. (1839–1937), an American industrialist, revolutionized the petroleum industry by founding the Standard Oil Company in 1870. This company dominated 90% of U.S. oil refining, making Rockefeller one of the world’s first billionaires. However, his aggressive, trust-based business tactics led to an unprecedented monopoly, drawing intense public scrutiny and legal action.

Retiring in the mid-1890s, Rockefeller turned to philanthropy, donating over $500 million to educational, scientific, and religious causes. He established the University of Chicago, Rockefeller University, and the Rockefeller Foundation, leaving behind a complex legacy as both a ruthless “robber baron” and a transformative benefactor.

John Dustin Archbold, born in Leesburg, Ohio, in 1848, rose to prominence as a prominent American industrialist. He played a pivotal role in the development of the United States oil industry, closely associated with John D. Rockefeller. Archbold’s career began in the Pennsylvania oil regions, where he established his own oil company. However, his independent venture was later acquired by the Standard Oil Company.

Archbold’s expertise and leadership quickly propelled him through the ranks. He served as the primary spokesperson for Standard Oil and managed complex negotiations during federal antitrust hearings. After 1896, Archbold assumed the role of vice president, overseeing the daily operations of the company. His primary focus was on stabilizing, optimizing, and reducing waste in petroleum refining and distribution.

As a central figure in the Standard Oil trust, Archbold’s leadership was often controversial. In 1911, after the Supreme Court ordered the dissolution of the company, Archbold became the president of the Standard Oil Company of New Jersey.

Beyond his business endeavors, Archbold was a significant philanthropist. Notably, he donated nearly $4 million to Syracuse University, which funded the construction of Archbold Stadium, a gymnasium, and a dormitory. Despite his high-ranking position, Archbold maintained a relatively low public profile. He was a prominent figure in the Gilded Age, serving as the “voice” of the company during turbulent legal battles. Archbold passed away in 1916, leaving behind a lasting legacy in American corporate history, though his legacy was often shrouded in controversy.

William Henry Beardsley was a prominent American businessman who played a critical role in the development of Florida’s infrastructure during the late 19th and early 20th centuries. Born in Cleveland, Ohio, on April 7, 1852, Beardsley eventually became a key associate of industrialist Henry Flagler. He rose through the ranks of the Flagler system, serving as the President of the Florida East Coast Railway and holding executive positions within the Model Land Company and various hotel interests. His administrative expertise was vital in managing the logistical complexities of Flagler’s "Empire," which transformed Florida from a sparsely populated frontier into a burgeoning tourism and agricultural hub.

Beyond his logistical contributions to the railway, Beardsley was respected for his steady leadership during the transition of the Flagler enterprises following the founder's death in 1913. He oversaw the continued expansion and stabilization of the rail lines that connected the Florida Keys to the mainland, an engineering marvel of the era. Beardsley remained an influential figure in New York and Florida business circles until his death on December 13, 1925. Today, he is remembered as a quintessential behind-the-scenes architect of the Florida Land Boom, whose fiscal management ensured the longevity of the state's most vital transportation arteries.

Joel F. Freeman, a prominent executive within the Standard Oil Trust during the late 19th century, played a crucial role as one of John D. Rockefeller’s key lieutenants. As the company transitioned from a collection of loosely affiliated refineries into a centralized global powerhouse, Freeman assumed the pivotal role of Treasurer. His meticulous financial stewardship was instrumental during a period of aggressive expansion and horizontal integration. Freeman meticulously managed the company’s vast capital reserves, ensuring Standard Oil maintained the liquidity necessary to acquire competitors and invest in the rapidly developing pipeline infrastructure that ultimately secured the company’s monopoly over the American oil industry.

Beyond his technical expertise in finance, Freeman embodied the professionalization of corporate management that defined the Gilded Age. He belonged to the elite circle of executives who operated out of the renowned 26 Broadway headquarters in New York City. His influence extended beyond the company’s walls, as he served on the boards of various banks and industrial enterprises. This collaboration further intertwined the interests of Standard Oil with the broader American financial establishment. While lacking the public prominence of Rockefeller or Flagler, Freeman’s behind-the-scenes efforts in stabilizing the Trust’s fiscal health enabled Standard Oil to withstand the turbulent economic cycles of the 1880s and 1890s.

Ebay ID: labarre_galleries