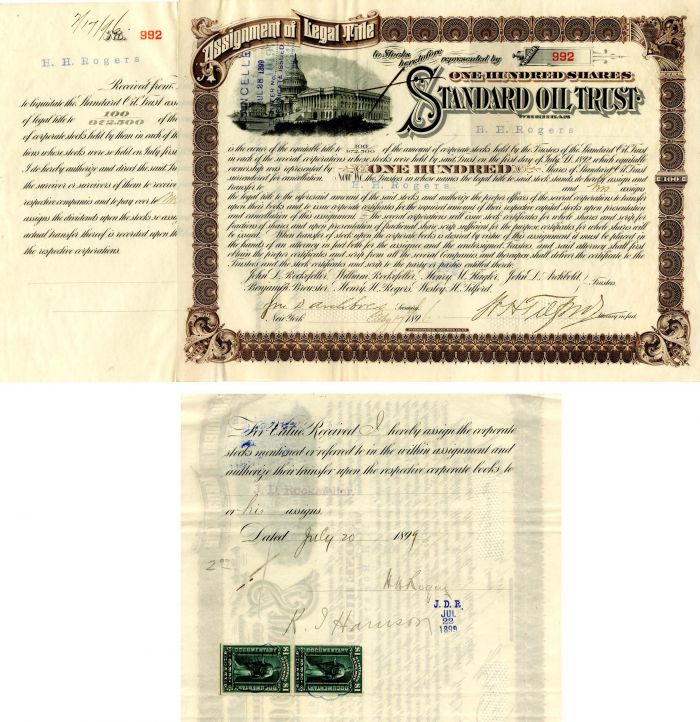

Standard Oil Trust signed by H.H. Rogers, John D. Archbold, Wesley H. Tilford and transferred to J.D. Rockefeller - Stock Certificate

Inv# AG1918 Stock

Stock signed by John D. Archbold as secretary, W.H. Tilford as attorney, H.H. Rogers on back and transferred to J.D. Rockefeller. Printed by International Bank Note Co., N.Y. Portraits available upon request.

John Dustin Archbold (born July 26, 1848, in Leesburg, Ohio; died December 6, 1916, in Tarrytown, New York) was a prominent American capitalist and one of the pioneering oil refiners in the United States. His modest oil enterprise was acquired by John D. Rockefeller's Standard Oil Company. Archbold quickly advanced within Standard Oil, managing numerous intricate and confidential negotiations throughout the years. By 1882, he had become Rockefeller's closest confidant and frequently served as the company's principal spokesperson. Following 1896, Rockefeller delegated business responsibilities to Archbold as he focused on his philanthropic endeavors; as vice president, Archbold effectively oversaw the operations of Standard Oil until his passing in 1916. Influenced by Rockefeller's strategies, Archbold prioritized stabilization, efficiency, and the reduction of waste in the refining and distribution of petroleum products. In 1911, the Supreme Court mandated the dissolution of the company into approximately thirty-six smaller entities, after which Archbold assumed the presidency of the largest, Standard Oil of New Jersey.

Wesley H. Tilford (1850-1909) was born on July 14, 1850, in Lexington, Kentucky. He attended Columbia College for a brief period; however, the allure of the business world compelled him to abandon his pursuit of a bachelor's degree. Drawn by the potential of the petroleum industry, Wesley left his studies and took a position as a clerk at his brother's firm, Bostwick & Tilford, located on Pearl Street. Following the dissolution of the firm, the brothers established their own partnership under the name John B. Tilford Jr. & Co., which experienced immediate success and continued to thrive. Eventually, during the era of Eastern oil consolidations, they received a lucrative offer from the Standard Oil Company, prompting them to align their interests with this dynamic organization. These were indeed pivotal times in the oil sector, and Wesley demonstrated his capabilities through a highly successful trip to the Pacific Coast in 1878, where he played a key role in organizing the oil trade across California, Oregon, Colorado, and neighboring states.

Upon his return to the East, he was greeted with a prominent position within the home office, where he energetically and effectively addressed the extensive transportation challenges. With the respect and trust of his colleagues firmly established, he maintained this standing until the end of his career. Tilford, who served as one of the Vice Presidents of the Standard Oil Company, left behind a distinguished legacy of over thirty years with the Company, along with several years in a petroleum enterprise associated with his family. Throughout his career, he navigated all levels of petroleum merchandising, consistently demonstrating loyalty, integrity, and insight in each role he undertook. Prior to his promotion to Vice President in 1908, he served as Treasurer of the Standard Oil Company for nine years and had been a Director since 1892. Despite his extensive and notable career, he remained relatively unknown outside the oil industry due to his unassuming nature. He was a man of few words, yet possessed a profound understanding of business matters, particularly excelling in organizational skills and possessing sound judgment. Additionally, he was well-read and knowledgeable across various subjects. His demeanor was courteous, compassionate, and generous. While ordinary qualities, enhanced by business experience, may suffice for navigating the intricacies of an established enterprise, achieving and maintaining a leading position in a dynamic and expanding business requires exceptional attributes. His colleagues attested that he consistently merited his advancements, a commendation from individuals who themselves were contemporaries of the titans of business throughout history.

Henry Huttleston Rogers (1840-1909) Henry Huttleston Rogers was born into a working-class family in Mattapoisett, Mass. He was the son of Rowland Rogers and Mary Eldredge Huttleston Rogers. Both parents had roots back to the pilgrims, who arrived in the 17th century aboard the Mayflower. His mother's family earlier had used the spelling "Huddleston" rather than "Huttleston," and Henry Rogers' name is often misspelled using this earlier version. In 1861, 21-year-old Henry pooled his savings of approximately $600 with a friend, Charles P. Ellis. They set out to western Pennsylvania and its newly discovered oil fields. Borrowing another $600, the young partners began a small refinery at McClintocksville near Oil City. They named their new enterprise Wamsutta Oil Refinery. In 1870, John D. Rockefeller formed Standard Oil Company of Ohio and started his strategy of buying up the competition and consolidating all oil refining under one company. It was during this period that the Pratt and Henry Rogers interests were brought into the fold. By 1878 Standard Oil held about 90% of the refining capacity in the United States. In the early 1871-72, H. H. Rogers was working for Pratt and Company and other refiners became involved in a conflict with John D. Rockefeller, Samuel Andrews, and Henry M. Flagler and the infamous South Improvement Company. South Improvement was basically a scheme to obtain secret favorable net rates from Tom Scott of the Pennsylvania Railroad and other railroads through secret rebates. The unfairness of the scheme outraged many independent oil producers and owners of refineries far and new alike. His final business achievement, working with partner William Nelson Page, was the building of the Virginian Railway from the coal fields of southern West Virginia to port near Norfolk at Sewell's Point, Virginia, in the harbor of Hampton Roads. For many years, it was labeled both an engineering marvel and the "richest little railroad in the world," forming part of today's rail network for Norfolk Southern. While considered ruthless in business matters, Henry Rogers also had a much kinder and generous side. His hometown of Fairhaven, Massachusetts continues to enjoy his many infrastructure gifts. Rogers' late life friendships included such diverse persons as Mark Twain, Ida Tarbell, Helen Keller, and Booker T. Washington. Rogers was a low-profile philanthropist with a widely hated public image as a robber baron. It was only after his death in 1909 that Dr. Washington felt he could publicly reveal that, over a period of more than 15 years, Henry Rogers had been funding over 65 small country schools and several larger institutions in the South for the betterment and education of African Americans. Dr. Washington not only credited Rogers with substantial aid and encouragement, but with instituting the then-innovative procedure of matching funds. Rogers felt that as well as extending the financial reach, their participation contributed to the beneficiaries' self-esteem and steps to self-sufficiency. He was listed in a 1996 study as one of the 25 all-time most wealthy individuals in United States history.

John Davison Rockefeller (1839-1937) Founder and one of the original partners of Standard Oil; Oil industry pioneer; Capitalist. At one time reputedly the world's richest man, Rockefeller began his career in Cleveland, Ohio as a successful merchant, prior to the Civil War. In 1863, he and his partners built a refinery which grew into a business that eventually absorbed many other Cleveland refineries and expanded into Pennsylvania oil fields to become the world's largest refining concern. During this time, he was able to expand his operations while others were failing due the talented people with whom he had surrounded himself, to the efficiency of his operations, and to a variety of what are now considered unscrupulous business practices for which he became famous. In 1870, Rockefeller organized the Standard Oil Company of Ohio in order to improve the efficiency with which his operations were being run. In 1882, in part to streamline operations, and in part to avoid state controls, Rockefeller took a step which had a profound significance for American business by creating the Standard Oil Trust. Under this arrangement, a board of trustees took the stock of both the Standard Oil Company of Ohio and of all of its subsidiaries, and ran the combination through the board's executive committee. By this time, public criticism of Rockefeller and his methods was running at near-fever pitch and, in 1892, the Trust was dissolved by the Ohio Supreme Court. The Trust was divided into some 18-later over 30-corporations before being folded into another holding company, Standard Oil of New Jersey (1899). In 1911, the U.S. Supreme Court ordered this latter company dissolved, declaring that it was "a monopoly in restraint of trade," and thus illegal under the Sherman Anti-Trust Act. By this time Rockefeller had almost completely removed himself from business concerns, and was concentrating solely on his philanthropic projects. While the extent of his philanthropies are too numerous to list, among the most prominent are his founding of the University of Chicago (1889), the Rockefeller Institute for Medical Research (1901), the General Education Board (1902) and the Rockefeller Foundation (1913). It is estimated that Rockefeller gave away some $550 million during his lifetime.

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries