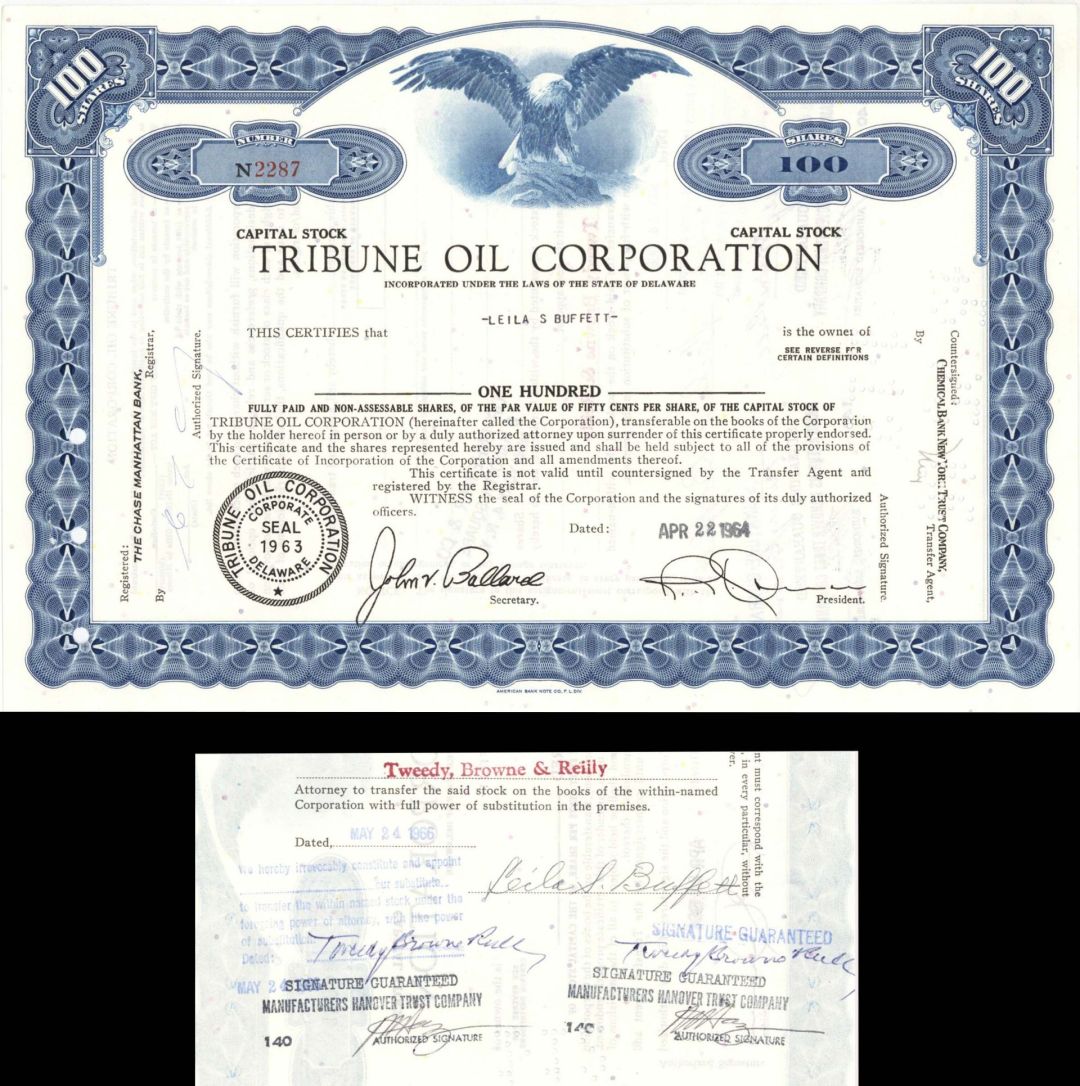

Tribune Oil Corp. Issued to and Signed by Leila S. Buffett - 1964 dated Autographed Oil Stock Certificate

Inv# AG2828 AutographOil Stock issued to Leila S. Buffett and signed on back. Eagle vignette with a nice border printed by the American Bank Note Co.

The oil industry in the United States comprises a vast array of companies involved in various activities, including exploration and production, transportation, refining, distribution, and marketing of oil. This sector is commonly categorized into three segments: "upstream," which encompasses exploration and production; "midstream," which involves transportation and refining; and "downstream," which pertains to distribution and marketing. The segment dedicated to oil exploration and production closely aligns with the sector focused on natural gas; however, the midstream and downstream components differ for each resource. While the term "major oil company" lacks a formal definition, it typically denotes a large, vertically integrated corporation that operates across most phases of the industry, from exploration to marketing. Many of these major companies have a global presence, and the largest among them are often referred to as supermajors.

This designation is frequently applied to companies such as BP, Shell, Exxon Mobil, Chevron, and Total, all of which have operations in the United States. Independent companies, on the other hand, primarily focus their operations within a specific segment of the industry, such as exploration and production, refining, or marketing. Although most independents are smaller in scale compared to the major companies, there are notable exceptions of large firms that are not vertically integrated and are thus classified as independents. Additionally, service companies provide specialized services to oil companies, including well logging (e.g., Schlumberger), seismic surveys (e.g., WesternGeco, CGG), drilling (e.g., Nabors Industries, Helmerich & Payne), and well completion (e.g., Baker Hughes, Halliburton). Furthermore, there exists a multitude of small oil producers whose combined crude oil output surpasses that of the major crude oil companies.

Leila Buffett formerly Stahl. Born 18 Mar 1904 in Nebraska. Daughter of John Ammon Stahl and Stella Frances Barber. Sister of Edith (Stahl) Kraft. She was the wife of Howard Homan Buffett — married 26 Dec 1925. Mother of Doris Eleanor Buffett and Warren Buffett. She died Aug. 30, 1996 at the age of 92.

Warren Edward Buffett (born August 30, 1930) is an American investor and philanthropist who currently serves as the chairman and CEO of Berkshire Hathaway. As a result of his investment success, Buffett is one of the best-known investors in the world. As of October 2024, he had a net worth of $147 billion, making him the eighth-richest person in the world. Buffett was born in Omaha, Nebraska. The son of US congressman and businessman Howard Buffett, he developed an interest in business and investing during his youth. He entered the Wharton School of the University of Pennsylvania in 1947 before graduating from the University of Nebraska at 19. He went on to graduate from Columbia Business School, where he molded his investment philosophy around the concept of value investing pioneered by Benjamin Graham. He attended New York Institute of Finance to focus on his economics background and soon pursued a business career. He later began various business ventures and investment partnerships, including one with Graham. He created Buffett Partnership Ltd. in 1956 and his investment firm eventually acquired a textile manufacturing firm, Berkshire Hathaway, assuming its name to create a diversified holding company. Buffett emerged as the company's chairman and majority shareholder in 1970. In 1978, fellow investor and long-time business associate Charlie Munger joined Buffett as vice-chairman. Since 1970, Buffett has presided as the chairman and largest shareholder of Berkshire Hathaway, one of America's foremost holding companies and world's leading corporate conglomerates. He has been referred to as the "Oracle" or "Sage" of Omaha by global media as a result of having accumulated a massive fortune derived from his business and investment success. He is noted for his adherence to the principles of value investing, and his frugality despite his wealth. Buffett has pledged to give away 99 percent of his fortune to philanthropic causes, primarily via the Bill & Melinda Gates Foundation. He founded the Giving Pledge in 2010 with Bill Gates, whereby billionaires pledge to give away at least half of their fortunes.

Ebay ID: labarre_galleries