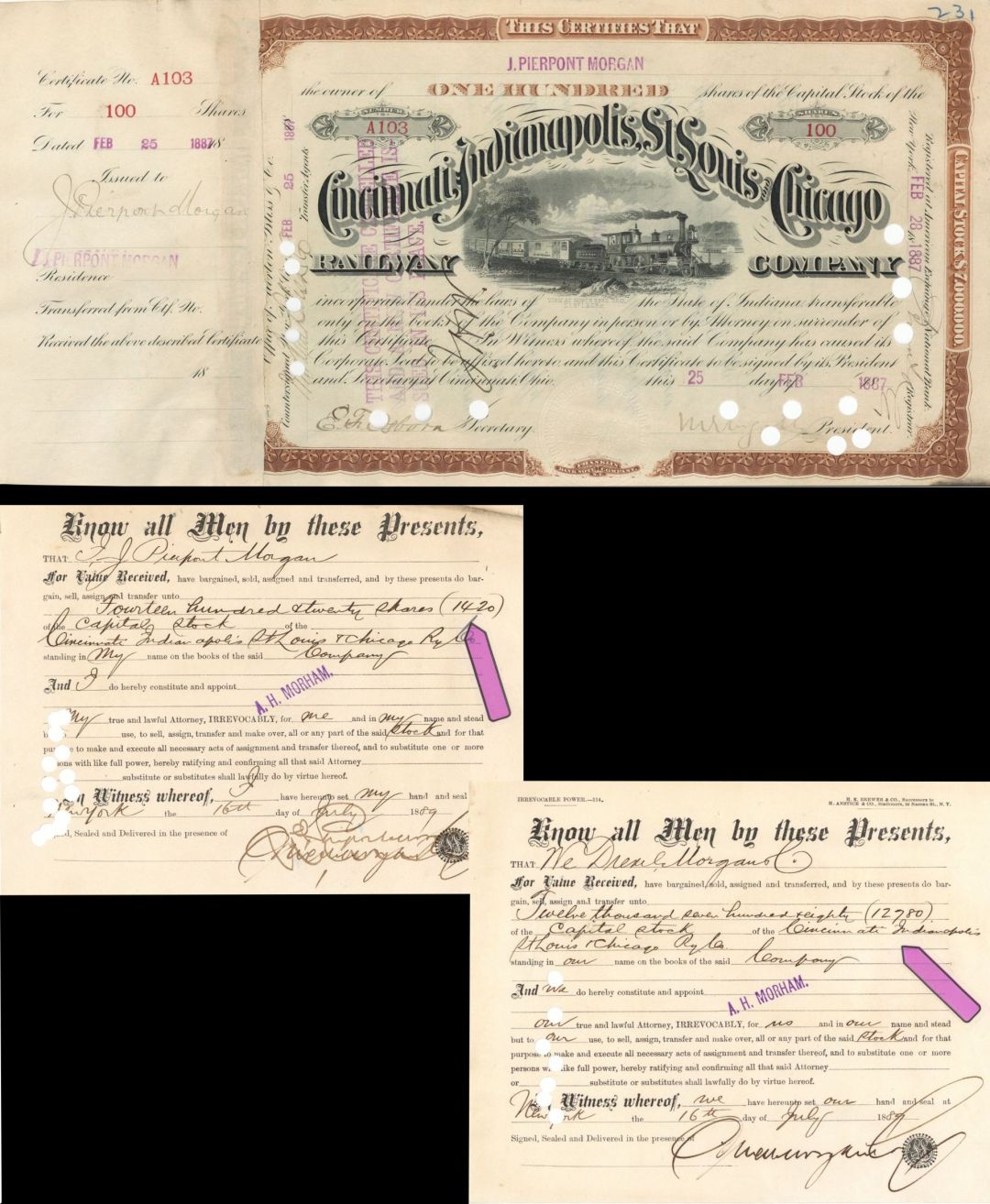

Group of 10 1887 dated Cincinnati, Indianapolis, St. Louis and Chicago Railway Co. signed Two Transfers by J. Pierpont Morgan - 1887 dated Autographed Stock Certificate - 2 Transfers Signed by JP Morgan

Inv# AG2708 StockIndiana

Missouri

Ohio

Two Transfers signed by JP Morgan. 10 Stocks of 100 shares each with Transfer receipts of 1,420 shares and another for 12,780 of the Cincinnati, Indianapolis, St. Louis and Chicago Railway Co. issued to and signed by J. Pierpont Morgan.

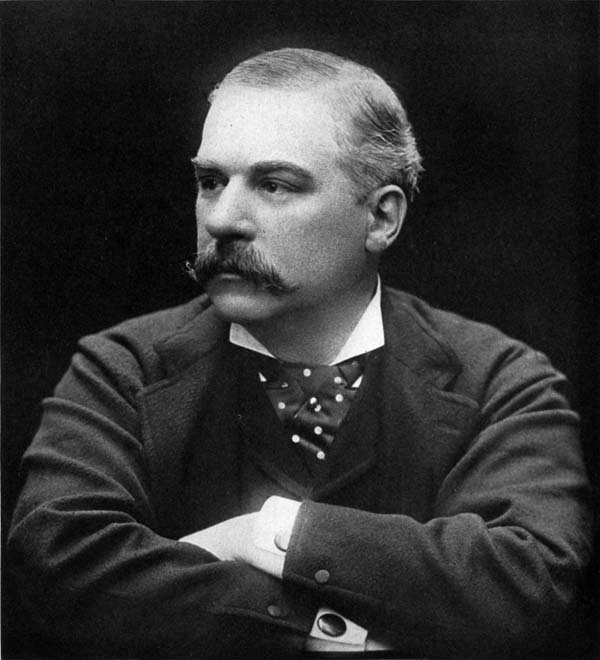

John Pierpont Morgan (1837–1913) was the preeminent American financier of the Gilded Age. He played a pivotal role in transforming the United States into a modern industrial superpower through the process of “Morganization.” Unlike many self-made tycoons of his era, Morgan was born into wealth. He refined his financial acumen through a rigorous European education before leading the banking firm that would eventually become JPMorgan Chase. Morgan specialized in consolidating chaotic and competing industries into efficient, massive corporations. He is most notable for creating General Electric in 1892 and U.S. Steel—the world’s first billion-dollar corporation—in 1901. Beyond industrial mergers, Morgan acted as the nation’s unofficial central banker, famously orchestrating private-sector bailouts to stabilize the American economy during the panics of 1895 and 1907.

While often criticized as a “robber baron” for his immense power and monopolistic practices, Morgan was also one of history’s most voracious art collectors and dedicated philanthropists. He amassed an encyclopedic collection of rare books, manuscripts, and Old Master paintings. Much of this collection was later donated to the Metropolitan Museum of Art or housed in the Morgan Library & Museum in New York City. Morgan’s legacy continues to be felt in 2026. Not only do the financial institutions he founded endure, but his treasures also have a global cultural impact. Morgan died in his sleep in Rome in 1913, leaving behind an estate valued at approximately $80 million. This fortune prompted contemporary John D. Rockefeller to remark that Morgan “wasn’t even a rich man” compared to the industrial giants he had financed.

The Cincinnati, Indianapolis, St. Louis, and Chicago Railway Company (CISL&C) was established in 1880 following the reorganization of the bankrupt Indianapolis, Cincinnati, and Lafayette Railroad. At its peak, the company operated a crucial 174-mile line connecting Cincinnati, Ohio, to Lafayette, Indiana, via Indianapolis. It controlled several branch lines, including the Harrison Branch and the Columbus, Hope, and Greensburg Railroad. Notably, it partnered with the Illinois Central Railroad to provide through-service from Kankakee to Chicago. Due to its lengthy official name, the railway became widely known by the more concise nickname, the “Big Four”.

The railway’s independent existence came to an end on June 30, 1889, when it merged with the Cleveland, Columbus, Cincinnati, and Indianapolis Railway and the Indianapolis & St. Louis Railway to form the Cleveland, Cincinnati, Chicago, and St. Louis Railway. This new consolidated entity retained the “Big Four” moniker and served as a significant regional carrier across Ohio, Indiana, Illinois, and Michigan. By the early 20th century, the system fell under the control of the New York Central Railroad, which fully leased its operations by 1930. Through further industry consolidations, the former CISL&C tracks eventually became part of Penn Central, Conrail, and ultimately the modern CSX and Norfolk Southern networks.

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries