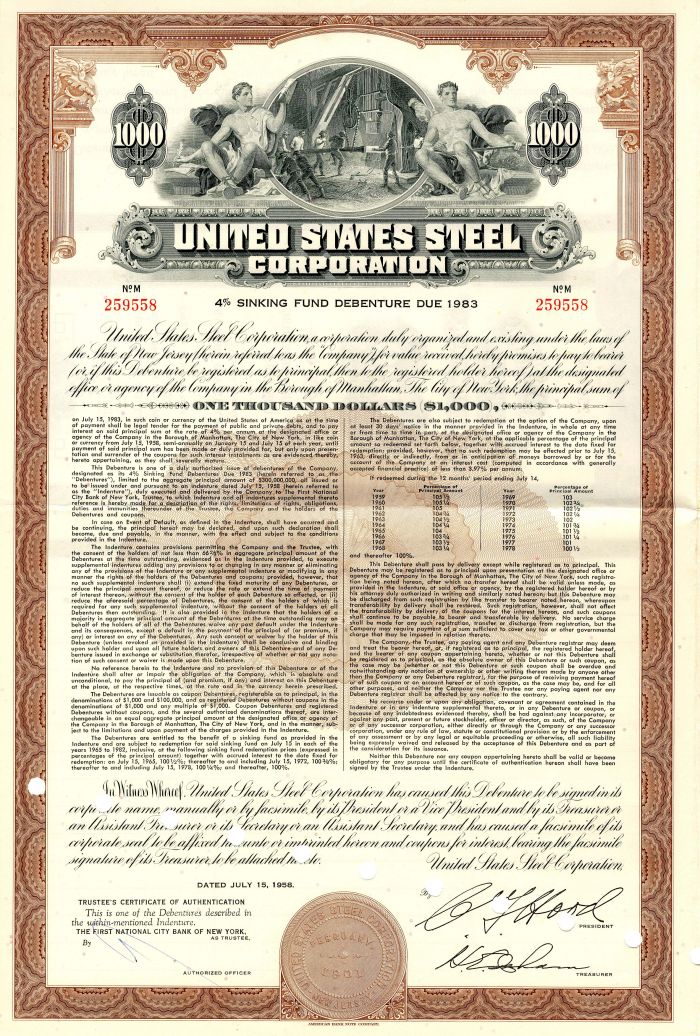

United States Steel Corporation - 1958 dated $1,000 4% Sinking Fund Bond - Very Rare Type

Inv# GB5585 Bond

$1,000 4% Bond printed by American Bank Note Company. Some coupons remain.

Established in 1901 through the merger of Andrew Carnegie’s Carnegie Steel with other prominent steel producers, the United States Steel Corporation (U.S. Steel) emerged as the world’s inaugural billion-dollar company and a pivotal force in American industrial expansion. Headquartered in Pittsburgh, Pennsylvania, the company maintained its dominance in the market for several decades, supplying the steel required for iconic American infrastructure and serving key sectors such as automotive, construction, and energy. Despite facing substantial competition and a decline in the latter half of the 20th century, which prompted a brief diversification into USX Corporation before its return to its core identity, U.S. Steel continues to operate as an integrated producer with significant operations, including Gary Works in Indiana and international facilities in Central Europe.

In June 2025, U.S. Steel embarked on a new chapter after being acquired by Japan’s Nippon Steel Corporation for approximately $14.9 billion. The culmination of this merger transpired amidst a complex regulatory process, wherein an initial opposition from the Biden administration was overruled by President Donald Trump under specific national security considerations. Presently operating as a wholly owned subsidiary of Nippon Steel, the company retains its name and Pittsburgh headquarters while maintaining its U.S. incorporation status. The merger agreement stipulates an $11 billion investment commitment by 2028 and a “Golden Share” for the U.S. government, which entails federal oversight and veto power over pivotal corporate decisions, including plant closures or relocations.

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Ebay ID: labarre_galleries