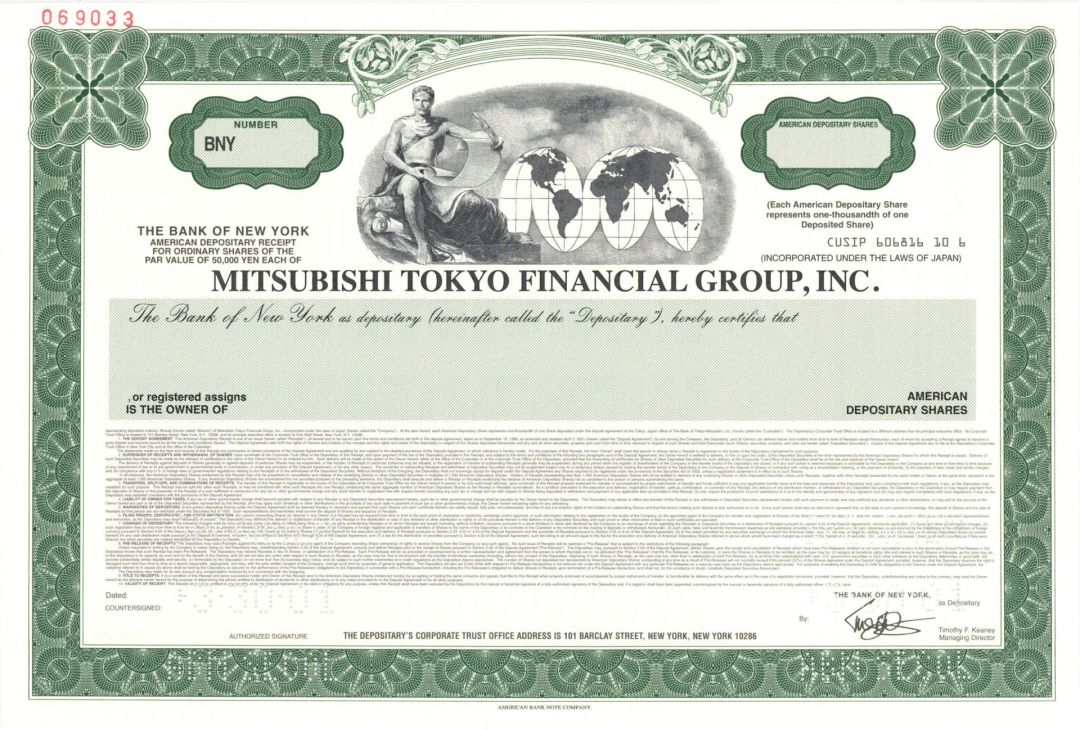

Mitsubishi Tokyo Financial, Inc. - Specimen Stock Certificate

Inv# SE3493 Specimen StockSpecimen Stock printed by American Bank Note Company. Mitsubishi UFJ Financial Group, Inc. is a Japanese bank holding and financial services company headquartered in Chiyoda, Tokyo, Japan. It is Japan's largest financial group and the world's second largest bank holding company holding around US$1.8 trillion (JPÂ¥148 trillion) in deposits as of March 2011. The letters MUFG come from Mitsubishi and United Financial of Japan. MUFG holds assets of around US$3.1 trillion as of 2016 and is one of the "Three Great Houses" of the Mitsubishi Group alongside Mitsubishi Corporation and Mitsubishi Heavy Industries. The company was formed on October 1, 2005, with the merger of Tokyo-based Mitsubishi Tokyo Financial Group (MTFG), and Osaka-based UFJ Holdings. The core banking units of the group, Bank of Tokyo-Mitsubishi and UFJ Bank, were merged on January 1, 2006, to form MUFG Bank. This integration was originally scheduled to take place on October 1, 2005, the same day that the parent companies were merged. However, pressure from Japan's Financial Services Agency, which wanted to ensure the smooth systems integration of the two banking giants, caused the merger of the banks to be postponed for three months. The trust banking and securities units of MTFG and UFJ were merged according to the original schedule on October 1, 2005.

On October 31, 2018, MUFG to acquire Australian Asset Manager, Colonial First State Global Asset Management. The financial group dates back to 1880 as the Yokohama Specie Bank, later renamed to The Bank of Tokyo. Also in 1880, The Mitsubishi Bank, Ltd. was founded by former samurai Yataro Iwasaki. In 1919, the Mitsubishi Bank financed the Mitsubishi zaibatsu, most of which is today Mitsubishi Heavy Industries. After the Second World War the Mitsubishi Keiretsu was broken up under US imposed laws, and Mitsubishi Bank took on greater independence, albeit still central to the financing of the growth of the Mitsubishi group of companies.

In April 1996, The Mitsubishi Bank, Ltd. and The Bank of Tokyo, Ltd. merged. The Bank of Tokyo had been set up by the Japanese Government to act as Japan's international bank, and solely responsible for all Yen forex trading. Uniquely in Japan, with no keiretsu, Bank of Tokyo was an ideal partner for Mitsubishi Bank, complementing the latter' strong domestic franchise with a unique international footprint. Additionally, during Japan's lost decade of economic stagnation, this marriage of two relatively strong banks was seen as a positive step in cleaning up the country's moribund banking sector. In July 2004, Japan's fourth-largest financial group UFJ Holdings offered to merge with the Mitsubishi Tokyo Financial Group. The merger of the two bank holding companies was completed on October 1, 2005. UFJ was created from a merger with the Toyo Trust and Banking. UFJ was accused by the government of corruption and making bad loans to the yakuza crime syndicates. The takeover of UFJ by the Mitsubishi Tokyo Financial Group was challenged by the Sumitomo Mitsui Banking Group, another of Japan's large banking groups, which launched a competing takeover bid. The Mitsubishi Tokyo Financial Group ultimately prevailed in the fight to acquire UFJ.

The battle between the two Japanese mega-banks seemed to signal an end to the clubby atmosphere that had prevailed in Japan's postwar banking industry. The trust banking and securities units of the two groups were merged on October 1, 2005. The core banking units of MTFG and UFJ, The Bank of Tokyo-Mitsubishi, Ltd. and UFJ Bank, respectively, continued to operate separately until January 1, 2006, when they were merged to form MUFG Bank. In September 2008, MUFG signed a letter of intent with Morgan Stanley to form an alliance and purchase 20% of the American firm. In 2008 at the 2008 ALB Japan Law Awards, Mitsubishi UFJ was crowned: In-House of the Year â Japan Investment Bank In-House Team of the Year Deal of the Year â Debt Market Deal of the Year In April 2011, MUFG and Morgan Stanley entered into an agreement to convert MUFG's outstanding convertible preferred stock in Morgan Stanley into Morgan Stanley stock.

Stock and Bond Specimens are made and usually retained by a printer as a record of the contract with a client, generally with manuscript contract notes such as the quantity printed. Specimens are sometimes produced for use by the printing company's sales team as examples of the firms products. These are usually marked "Specimen" and have no serial numbers.

Ebay ID: labarre_galleries