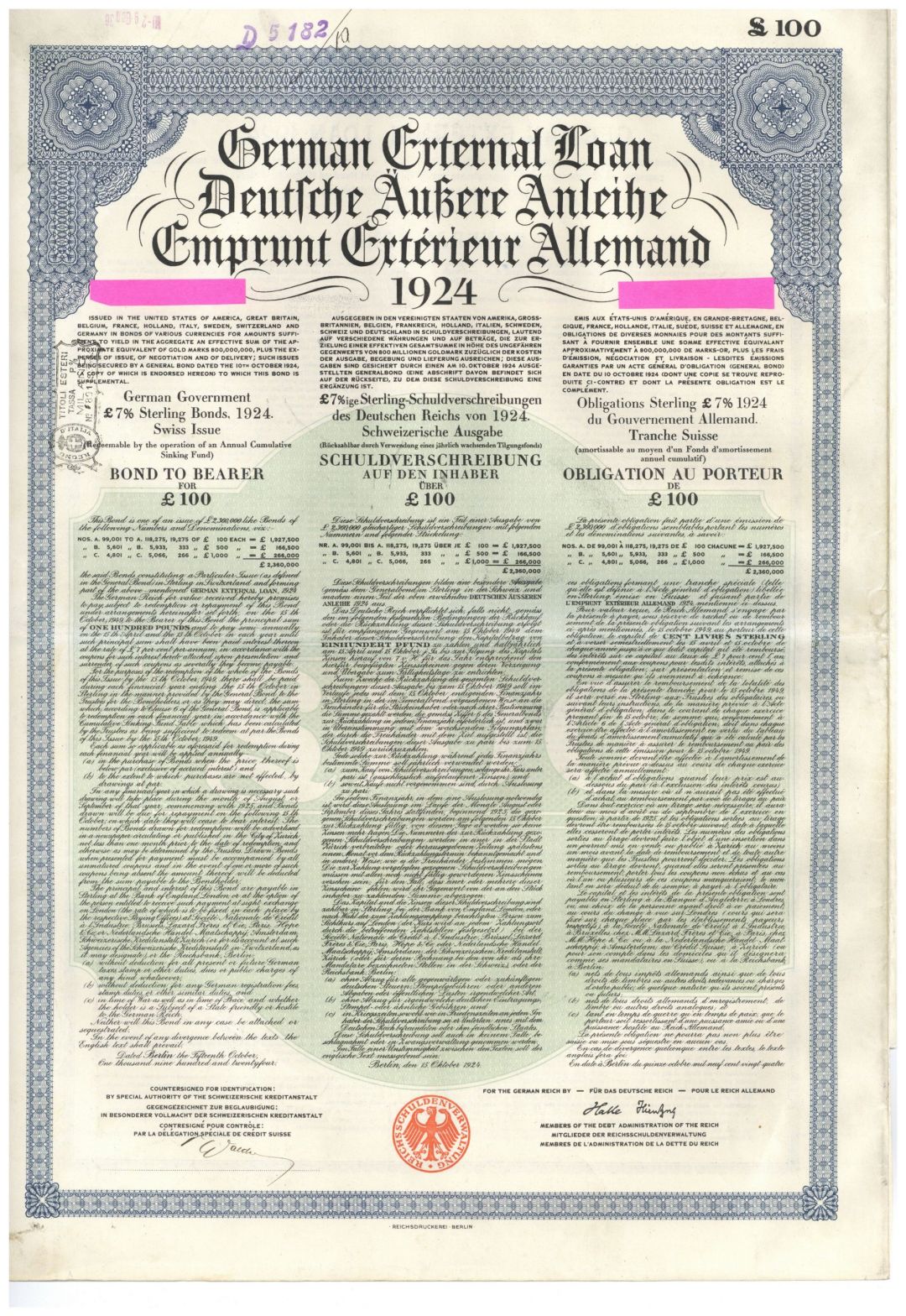

German External Dawes Loan Uncancelled 7% 1924 £100 or 100 British Pound Gold Bond with Pass-co Authentication (Uncanceled)

Inv# FB6575 Bond

German External Gold Loan Uncancelled 7% 1924 Gold Bond with the 9 traditional coupons remaining with PASS-CO AUTHENTICATION. Almost complete identical to the German Dawes $1,000 Bonds. Only difference is the denomination & the appearance.

The Dawes Plan, proposed by the Dawes Committee chaired by Charles G. Dawes, was a plan devised in 1924 to address the issue of World War I reparations owed by Germany. It successfully resolved a crisis in European diplomacy following World War I and the Treaty of Versailles. The plan involved ending the Allied occupation and implementing a staggered payment plan for Germany’s war reparations. Recognizing its significance in resolving a serious international crisis, Dawes shared the Nobel Peace Prize in 1925 for his contributions. However, the Dawes Plan proved to be an interim measure and was ultimately replaced by the Young Plan in 1929.

At the end of World War I, the Allied and Associated Powers, including Germany, agreed to pay reparations in the Treaty of Versailles. Initially, the figure was set at 20 billion gold marks, but it was later revised to 132 billion gold marks in 1921. However, only 50 billion gold marks were required to be paid.

German industrialists in the Ruhr Valley, who had lost factories in Lorraine, which was returned to France after the war, demanded hundreds of millions of marks in compensation from the German government. Despite its obligations under the Versailles Treaty, the German government paid the Ruhr Valley industrialists, which contributed significantly to the subsequent hyperinflation.

For the first five years after the war, coal was scarce in Europe, and France sought coal exports from Germany to fuel its steel industry. However, Germany needed coal for domestic heating and steel production, having lost its steel plants in Lorraine to France.

To protect the growing German steel industry, German coal producers, whose directors also sat on the boards of German state railways and steel companies, began to increase shipping rates on coal exports to France. In early 1923, Germany defaulted on its reparations, and German coal producers refused to ship any more coal across the border.

In response, French and Belgian troops occupied the Ruhr, compelling the German government to resume shipments of coal and coke. Germany characterized the demands as excessive under its post-war condition, as they represented 60% of what Germany had been shipping into the same area before the war began. This occupation of the Ruhr, the center of Germany’s coal and steel industries, outraged many German people.

There was passive resistance to the occupation, and the economy suffered, further contributing to the German hyperinflation.

To simultaneously resolve this situation and enhance the likelihood of Germany resuming reparation payments, the Allied Reparations Commission urgently requested Dawes to devise a solution promptly. The Dawes Committee, comprising ten informal expert representatives, each from Belgium (Baron Maurice Houtart and Emile Francqui), France (Jean Parmentier and Edgard Allix), Britain (Sir Josiah C. Stamp and Sir Robert M. Kindersley), Italy (Alberto Pirelli and Federico Flora), and the United States (Dawes and Owen D. Young, appointed by Commerce Secretary Herbert Hoover), was tasked with finding a solution for the collection of the German reparations debt, which was estimated to be 132 billion gold marks. Additionally, the Committee was mandated to declare that America would provide loans to Germany, enabling them to fulfill their reparations obligations to the United States, Britain, and France.

In an agreement signed in August 1924, the core principles of the Dawes Plan were outlined:

- The Ruhr region was to be evacuated by foreign troops.

- Reparation payments were to commence at one billion marks in the initial year, gradually increasing annually to two and a half billion marks after five years.

- The Reichsbank was to be reorganized under Allied supervision.

- The sources for the reparation funds were to include transportation, excise, and customs taxes.

- Germany was to be loaned approximately $200 million, primarily through Wall Street bond issues in the United States.

The bond issues were overseen by a consortium of American investment banks, led by J.P. Morgan & Co., under the supervision of the US State Department. Germany benefited significantly from the influx of foreign capital. The Dawes Plan, implemented in September 1924, shared the Nobel Peace Prize with Dawes and Sir Austen Chamberlain.

During the mid-1920s, Germany’s economy began to recover, and the country continued making reparations, now funded by the substantial influx of American capital. However, the Germans viewed the Dawes Plan as a temporary measure and anticipated a revised solution in the future. In 1928, German Foreign Minister Gustav Stresemann called for a final plan, which led to the enactment of the Young Plan in 1929.

The Dawes Plan resulted in the withdrawal of French troops from the Ruhr Valley. It provided a substantial capital influx to German industry, which continued to rebuild and expand. This newfound capital effectively shifted the burden of Germany’s war reparations from the German government and industry to American bond investors. The Dawes Plan also marked the beginning of the collaboration between German industry and American investment banks.

The Ruhr occupation led to a triumph for the German steel industry and the re-armament program. By reducing coal supplies to France, which heavily relied on German coal, German industrialists effectively crippled France’s steel industry while simultaneously rebuilding their own. By 1926, the German steel industry had become dominant in Europe, and this dominance only grew in the years leading up to World War II.

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Ebay ID: labarre_galleries