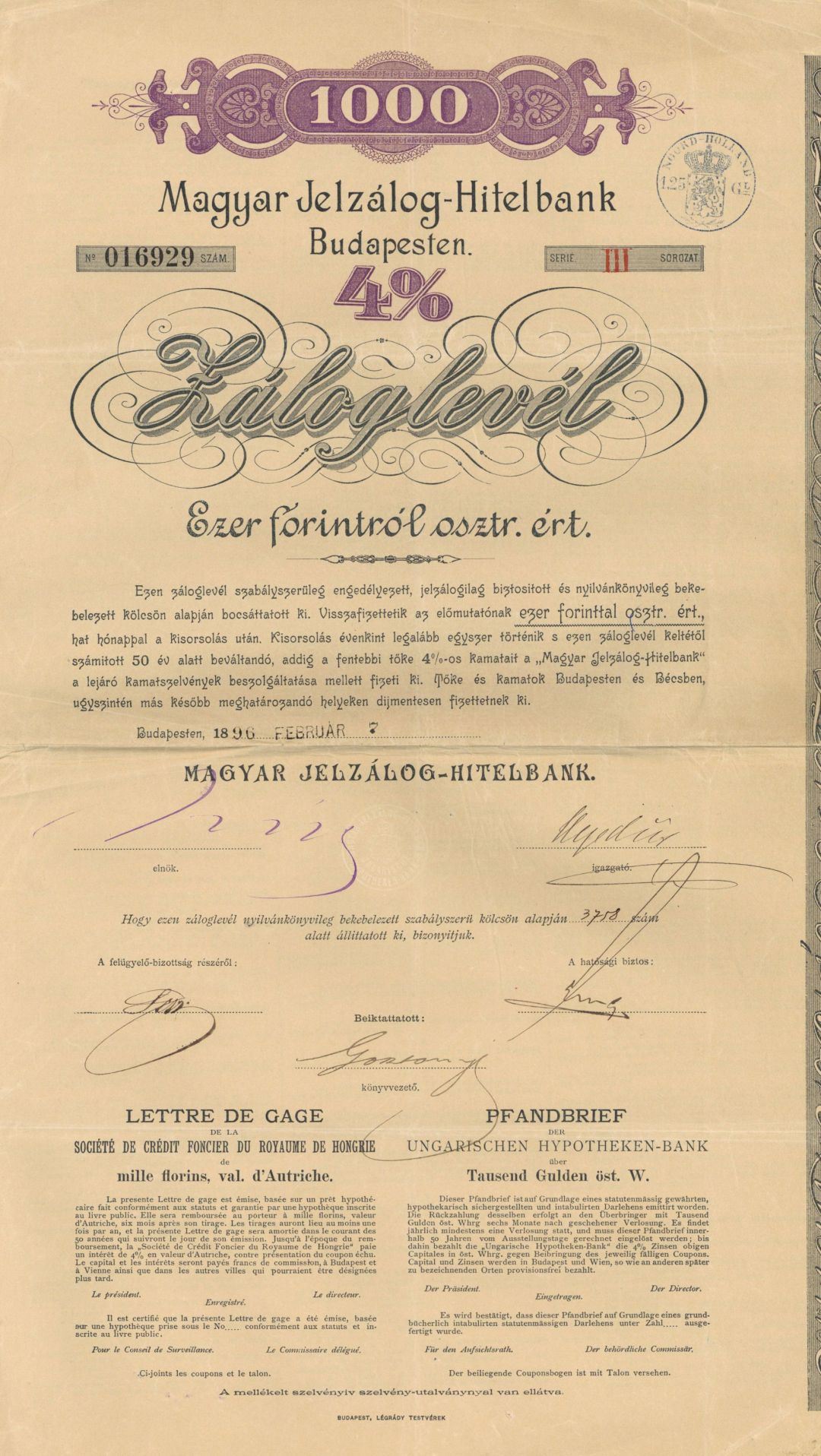

Magyar Jelzalog-Hitelbank Budapesten - 1,000 Forint Denomination Uncanceled Bond

Inv# FB6400 Bond1,000 4% Uncanceled Forint Bond with several coupons remaining.

The forint (sign Ft; code HUF) is the currency of Hungary. It was formerly divided into 100 fillér, but fillér coins are no longer in circulation. The introduction of the forint on 1 August 1946 was a crucial step in the post-World War II stabilisation of the Hungarian economy, and the currency remained relatively stable until the 1980s. Transition to a market economy in the early 1990s adversely affected the value of the forint; inflation peaked at 35% in 1991. Since 2001, inflation is in single digits, and the forint has been declared fully convertible. As a member of the European Union, the long-term aim of the Hungarian government may be to replace the forint with the euro, although under the current government there is no target date for adopting the euro.

The forint's name comes from the city of Florence, where gold coins called fiorino d'oro were minted from 1252. In Hungary, florentinus (later forint), also a gold-based currency, was used from 1325 under Charles Robert, with several other countries following Hungary's example.

Between 1868 and 1892, the forint was the name used in Hungarian for the currency of the Austro-Hungarian Empire, known in German as the gulden or florin. It was subdivided into 100 krajczár (krajcár in modern Hungarian orthography).

The forint was reintroduced on 1 August 1946, after the pengő was rendered almost worthless by massive hyperinflation in 1945–46: the highest ever recorded. This was brought about by a mixture of the high demand for reparations from the USSR, Soviet plundering of Hungarian industries, and the holding of Hungary's gold reserves in the United States. The different parties in the government had different plans to solve this problem. To the Independent Smallholders' Party—which had won a large majority in the 1945 Hungarian parliamentary election—as well as the Social Democrats, outside support was essential. However, the Soviet Union and its local supporters in the Hungarian Communist Party were opposed to raising loans in the West, and thus the Communist Party masterminded the procedure using exclusively domestic resources. The Communist plan called for tight limits on personal spending as well as the concentration of existing stocks in state hands.

The forint replaced the pengő at the rate of 1 forint = 4×1029 pengő—dropping 29 zeroes from the old currency. In fact, this was an imaginary exchange rate. With the highest value note being 100 million B. pengő (1020 pengő), the total amount of pengő in circulation had a value of less than 0.1 fillér. (The "B" stood for a long scale "billion", i.e. a million million.) Of more significance was the exchange rate to the adópengő of 1 forint = 200 million adópengő.

Historically the forint was subdivided into 100 fillér (comparable to a penny), although fillér coins have been rendered useless by inflation and have not been in circulation since 1999. (Since 2000, one forint has typically been worth about half a US cent or slightly less.) The Hungarian abbreviation for forint is Ft, which is written after the number with a space between. The name fillér, the subdivision of all Hungarian currencies since 1925, comes from the German word Vierer which denoted a four-krajcár-piece. The abbreviation for the fillér was f, also written after the number with a space in between.

When the forint was introduced, its value was defined on the basis of 1 kilogram of gold being 13,210 forints. Therefore, given that gold was fixed at US$35 per Troy ounce, one USD was at that time worth 11.74 forints.

After its 1946 introduction, the forint remained stable for the following two decades, but started to lose its purchasing power as the state-socialist economic system (Planned economy) lost its competitiveness during the 1970s and 1980s. After the democratic change of 1989–90, the forint saw yearly inflation figures of about 35% for three years, but significant market economy reforms helped stabilize it.

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Ebay ID: labarre_galleries