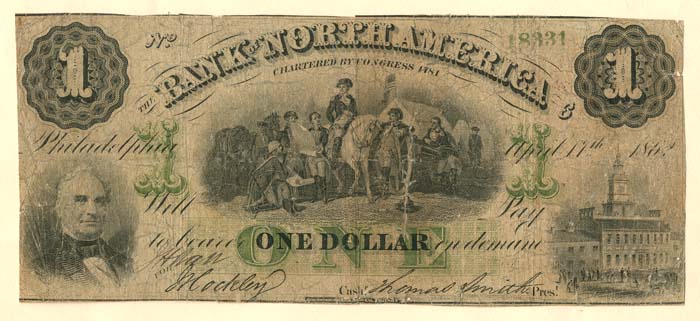

Bank of North America - Obsolete Bank Note

Inv# OB1467

$1, H305-41. Rare!

The Bank of North America was the first chartered bank in the United States, and served as the country's first de facto central bank. Chartered by the Congress of the Confederation on May 26, 1781, and opened in Philadelphia on January 7, 1782, it was based upon a plan presented by US Superintendent of Finance Robert Morris on May 17, 1781, based on recommendations by Revolutionary era figure Alexander Hamilton. Although Hamilton later noted its "essential" contribution to the war effort, the Pennsylvania government objected to its privileges and reincorporated it under state law, making it unsuitable as a national bank under the federal Constitution. Instead Congress chartered a new bank, the First Bank of the United States, in 1791.

In May 1781 Alexander Hamilton revealed that he had recommended Robert Morris for the position of Superintendent of Finance of the United States the previous summer when the constitution of the Articles of Confederation-era executive was being solidified. Second, he proceeded to lay out a proposal for a national bank that would also serve as a de facto central bank. Morris, who had corresponded with Hamilton previously on the subject of funding the war, immediately drafted a legislative proposal based on Hamilton's suggestion and submitted it to the Congress. Morris persuaded Congress to charter the Bank of North America, the first private commercial bank in the United States.

The original charter as outlined by Hamilton called for the disbursement of 1,000 shares priced at $400 each. Benjamin Franklin purchased a single token share as a sign of good faith to Federalists and their new bank. Hamilton used his pseudonym "Publius" (later immortalized in the Federalist Papers advocating in the late 1780s for adoption of the United States Constitution) to endorse the bank.

William Bingham, rumored to be the richest man in America after the Revolutionary War, purchased 9.5% of the available shares.

The greatest share, however, 63.3%, was purchased on behalf of the United States government by Robert Morris using a gift in the form of a loan from France, and a loan from the Netherlands. This had the effect of capitalizing the bank with large deposits of gold and silver coin and bills of exchange. He then issued new paper currency backed by this supply.

Thomas Willing, a twice former mayor of Philadelphia and partner with Morris in an import-export firm (that included slaving), was named the bank's first president. He held that office from 1781–1791, being succeeded by John Nixon, and moving immediately on to become the first president of the First Bank of the United States, a position he held from 1791 to 1807.

By 1783, Congress and several states including Massachusetts enacted legislation, allowing Americans to pay taxes with Bank of North America certificates, giving them a crucial aspect of legal tender.

In the economic turmoil that followed the Revolutionary War, the bank's strictness in collecting debts drew opposition from Pennsylvania residents, who petitioned the General Assembly to revoke the state charter granted to it in 1782. This was done in 1785, although the bank continued to operate with difficulty under its congressional charter and then under a Delaware charter. The following year the Assembly granted a new charter with several restrictions, including that it could not trade any merchandise other than bullion. The Bank of North America, along with the First Bank of the United States and the Bank of New York were the first shares traded on the New York Stock Exchange.

After the passage of the National Bank Act in 1862, the Bank of North America converted its business to operate under the new law. Its unique history presented a problem: the act required a national bank to include the word "national" in its name. The bank's management considered its original name a matter of prestige and took the position that the name remained fixed by the Confederation charter. The Comptroller of the Currency chose not to press these legal questions and admitted the bank without a name change.

The bank merged in 1923 with the Commercial Trust Company to become the Bank of North America and Trust Company, which merged in 1929 with the Pennsylvania Company for Insurance on Lives and Granting Annuities. This was acquired by First Pennsylvania Bank (1955), CoreStates Financial Corporation (1991), First Union/Wachovia (1998) and Wells Fargo (2008).

Ebay ID: labarre_galleries