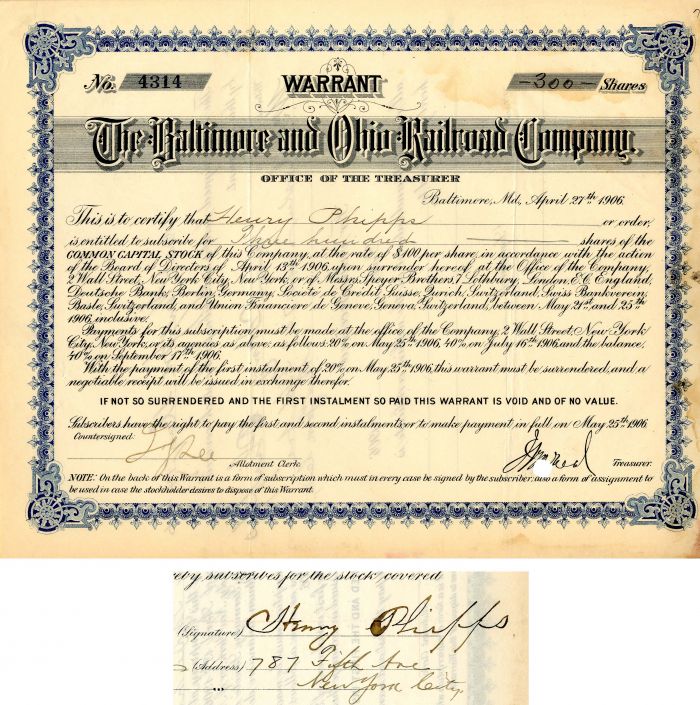

Baltimore and Ohio Railroad Co. signed by Henry Phipps - Warrant Certificate

Inv# AG2065 Stock

Stock signed by Henry Phipps.

Henry Phipps Jr. (September 27, 1839 – September 22, 1930) was an American entrepreneur known for his business relationship with Andrew Carnegie and involvement with the Carnegie Steel Company. He was also a successful real estate investor. After selling his stock in Carnegie Steel, he devoted a great deal of his time and money to philanthropic works. He was the son of English born Hannah Frank and Henry Phipps, an English shoemaker who migrated to Philadelphia in the early part of the 19th century before settling in Pittsburgh in 1845. He was educated at public schools in Allegheny City, Pennsylvania. He had one sister, Amelia Phipps Walker (Mrs. John Walker; 1846-1887), and two brothers: William Henry Phipps (1825-1902), and John Phipps (1833-1860), who was also friends with Carnegie and who died young. Phipps began working as a young man as an office boy and later a bookkeeper with Dillworth & Bidwell. In 1861, he became a partner in Bidwell & Phipps, which was an agent for the du Pont Powder Company, and a partner in Kloman & Phipps, a small iron mill. In 1865, he became a partner in childhood friend and neighbor's Andrew (1835–1919) and Thomas Carnegie's (1843–1886) Union Iron Mills, which was created from a merger between Phipps' Kloman & Phipps and Cyclops Iron Company, an iron company which the Carnegies had acquired an interest in. Kloman and Phipps at first refused, but Thomas made an offer of all the shares in Cyclops plus an additional payment of $50,000 (equivalent to $835,000 in 2019). Therefore, on May 1, 1865, the new Union Iron Mills Company was formed. For the next year, Phipps and Carnegie went to Europe on tour, and when they returned in 1866, went to work.

Phipps toiled for the next 20 years and proved a capable financier, becoming Carnegie's business partner in Carnegie Steel Company, founded in 1892, which would make him a very wealthy man as the company's second largest shareholder. In 1901, Carnegie Steel Company was sold to the United States Steel Corporation; a newly formed organization, set up by Pierpont Morgan. It sold for $400 million (approx. $13.3 billion today), of which $226 million went to Carnegie himself, and $48 million went to Phipps. In 1907, Henry Phipps established Bessemer Trust Company to manage his substantial assets that would be shared by his offspring following his death. In 1909, Phipps expanded his Cape Cod holdings to the entire 800 acre Great Island on Cape Cod, purchasing the remaining 50 acres from Charles B. Cory (1857–1921). The Cape Cod estate was next to Aberdeen Hall (which burnt down in September 1924 and was near Andrew Carnegie, Henry M. Flagler, and Henry Clay Frick's estates. In 1912, Phipps divided $3,000,000 (equivalent to $79,479,000 in 2019) worth of real estate in Chicago, Illinois realty among his three sons.

Later in the same year, he also gave his sons $10,000,000 (equivalent to $264,931,000 in 2019) worth of property in Pittsbugh. In 1916, he purchased property in Great Neck, Long Island in the Village of Lake Success and in 1917, began construction on a thirty-nine-room Georgian mansion summer home, which was completed in 1919. He named the home, Bonnie Blink, which is Scottish for Pretty View. After his death, the mansion and property were donated to the school district and have since become William A. Shine Great Neck South High School. In 1926, he bought Island Beach, which was sold by his heirs in 1953 to the State of New Jersey. Now known as Island Beach State Park, it is the last remaining stretch of undeveloped barrier island on the central New Jersey coast. Phipps was one of the pioneer investors in Florida real estate. At one time, he and his family owned one-third of the town of Palm Beach, 28 miles (approximately 45 kilometers) of oceanfront between Palm Beach and Fort Lauderdale, prime bay front property in downtown Miami, and 29,653 acres (approximately 12,000 hectares) of land in Martin County.

The Phipps family donated to the town of Palm Beach one of the most significant gifts in county history: an ocean-to-lake frontage property that is now known as Phipps Park. Phipps believed that those who have achieved great wealth should give back for the public good and create institutions dedicated to that purpose. As such he was involved with a number of philanthropic causes, the best known of which is the Phipps Conservatory and Botanical Gardens in Schenley Park, an 1893 gift to the city of Pittsburgh. Among his many benevolent works, he also funded the Phipps Institute for the Study, Treatment and Prevention of Tuberculosis at the University of Pennsylvania and The Henry Phipps Psychiatric Clinic at Johns Hopkins Hospital which in 1913 made possible the first inpatient facility in the United States for the mentally ill constructed as part of an acute care hospital. Phipps was also an advocate of decent housing for the poor and in 1905 Phipps funded the non-profit Phipps Houses to build affordable housing in New York City. He gave $1,000,000 (equivalent to $28,456,000 in 2019) to build tenement houses for "working people." Phipps Houses still operates to this day; Henry Phipps's great-grandson, Stuart S. Janney III, sits on its Board of Trustees.

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries