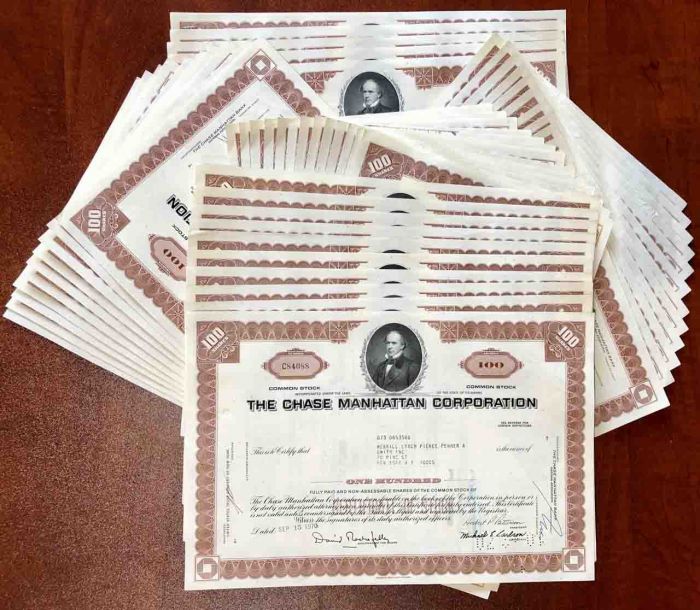

50 Pieces of Chase Manhattan Corporation - 50 Stock Certificates dated 1969-70 - With David Rockefeller's Facimile Signature

Inv# WW1024 Stock

Classic vignette of Secretary of the Treasury, Salmon P. Chase by American Bank Note. One of the largest banks in the world. Mixed colors. 50 pieces

JPMorgan Chase Bank, N.A., doing business as Chase Bank or often as Chase, is a national bank headquartered in Manhattan, New York City, that constitutes the consumer and commercial banking subsidiary of the U.S. multinational banking and financial services holding company, JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000. Chase Manhattan Bank was formed by the merger of the Chase National Bank and The Manhattan Company in 1955. The bank merged with Bank One Corporation in 2004 and later acquired the deposits and most assets of The Washington Mutual.

Chase offers more than 4,700 branches and 16,000 ATMs nationwide. JPMorgan Chase & Co. has 250,355 employees (as of 2016) and operates in more than 100 countries. JPMorgan Chase & Co. had their assets of $2.49 trillion in 2016. JPMorgan Chase, through its Chase subsidiary, is one of the Big Four banks of the United States. From September 1, 1799, to 1955, it was called The Bank of The Manhattan Company (New York); after a 1955 merger with the Chase National Bank (which existed separately from 1877 to 1954) it was called The Chase Manhattan Bank. Read more at https://en.wikipedia.org/wiki/JPMorgan_Chase

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries